The IPO Window is OPEN

To Our Clients, Friends and Colleagues:

The two of us have regular contact with venture capital and private equity partners, as well as CEOs and other business leaders and owners. For the past year and even in the past week, a good number of them ask us: “when will the IPO market return?” When we tell them that the market is open today, some are skeptical. The bottom line is this: the IPO market is OPEN and there is meaningful demand for companies that are priced appropriately and have strong management, durable business models and solid long-term prospects. Well-positioned businesses are pricing their IPOs above price talk and are trading well in the aftermarket. If we are right in our belief that we are in the early innings of a normal capital markets cycle, then taking a company public in the next twelve months would be excellent timing, particularly for owners who would like to partially or fully exit their positions over the next 18 to 36 months.

We believe part of the reason many people still believe the IPO market is not healthy today is that the runaway 2021 IPO market and its aftermath are seared in their memories. We believe that period was remarkably unique (open-ended stimulus, compounded by super low interest rates) and, while incredibly and temporarily enjoyable, it was not the “real world” and certainly not sustainable. We strongly and humbly suggest that everyone forget what you saw or experienced in 2021 and trust in the reality that today we are in a more sustainable, realistic and durable market cycle. What we are seeing is not contained to only larger companies, as there are significant early signs of a rotation into small/mid capitalization equities. The Russell 2000 has outperformed the S&P 500 by 10% in July, the largest monthly outperformance since 2000. Interest rates have stabilized, operating profits are reasonable, and investors are looking for value across the spectrum of sectors and regions. We see this because we and our team speak to investors across the globe daily, and this message is widespread.

When the public markets provide the best opportunity for value maximization and realization, there should be no hesitation to act. Accessing this market takes time and a lot of work, and we have many clients who are actively engaged in this process today. Our goal with this note is to make sure all of our clients are aware of what we see so they do not overlook this viable option to recognize and realize value.

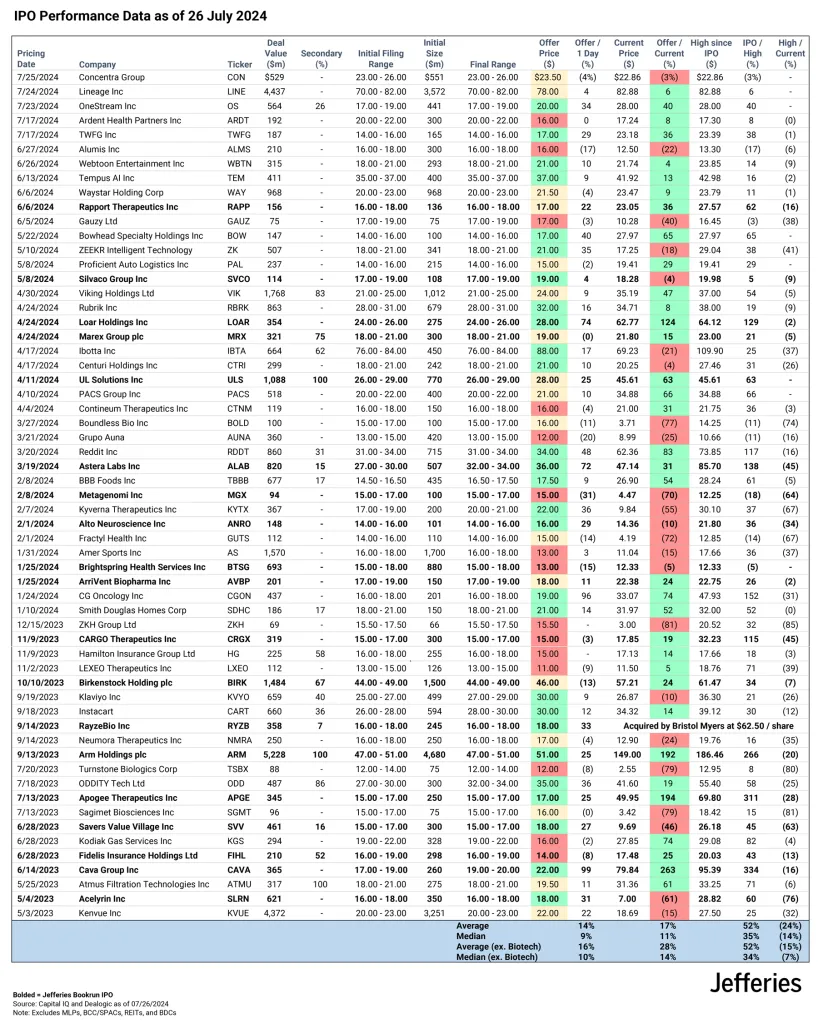

For background, below is a schedule of U.S. IPO performance since May 2023, which we mark as the beginning of the opening of this IPO window. You will see solid initial pricing and overall strong aftermarket performance. Nobody has a perfect crystal ball, but from what we see today, we are optimistic that normal IPO activity levels are not that far away. All of us at Jefferies are standing by to assist you with the IPO option, as well as every other avenue to achieve your strategic goals.

Publicly wishing you the best,

Rich and Brian

RICH HANDLER

CEO, Jefferies Financial Group

1.212.284.2555

[email protected]

@handlerrich X | Instagram

he, him, his

BRIAN FRIEDMAN

President, Jefferies Financial Group

1.212.284.1701

[email protected]

he, him, his