2023 was a paradoxical year for the energy transition, marked by unparalleled progress and notable new challenges. Renewable energy installations grew at a record pace, as solar capacity, EV sales, and battery storage surged to new highs in the United States and China.

However, amid global progress, new roadblocks emerged: over 1,500 GW of solar and wind power are delayed in grid interconnection queues, and the transition contends with increasing capital costs and inflation. Low-carbon stocks also performed poorly, even as the broader market recovered.

As we begin 2024, a pivotal year for the global transition, this mix of promising developments and persistent challenges raises three key questions:

- What do voters want? In 2024, the largest election year in history, up to 4 billion people in 76 countries will vote. The outcomes of these elections will shape the global energy transition over the next half decade.

- Will roadblocks hinder progress? Costly capital and ongoing supply chain challenges threaten the transition’s momentum.

- Will we see continued breakthroughs in climate tech? Major innovations, like another nuclear fusion moment, could significantly change the pace and potential of decarbonization.

Here are the eight moments Jefferies is monitoring in 2024 – each poised to shape the trajectory of global progress in the year ahead and beyond.

- ESG and the Energy Transition Are on the Ballot

- China: Could Emissions Peak in 2024?

- Japanese Transition Bonds

- India: Coal Expansion and Renewable Energy Go Head-to-Head

- Will Grid Bottlenecks Persist?

- Rising Capital Costs Pose New Challenges

- Does Carbon Capture and Storage (CCS) Deliver on its Promise?

- The EU Innovation Fund

ESG and the Energy Transition Are on the Ballot

As 76 countries and up to 4 billion people head to the ballots, two elections particularly stand out: the United States and the European Parliament.

The United States presidential election, likely featuring a rematch between President Biden and former President Trump, could critically influence U.S. energy policy and support for decarbonization. Former President Trump has indicated intentions to repeal parts of the Inflation Reduction Act.

Elections for the European Parliament will also prove critical. The current leading party, the European People’s Party, has supported legislation within the European Green Deal. The outcome of 2024 elections could see Europe reaffirm its support for the energy transition – or shake up the status quo.

China: Could Emissions Peak in 2024?

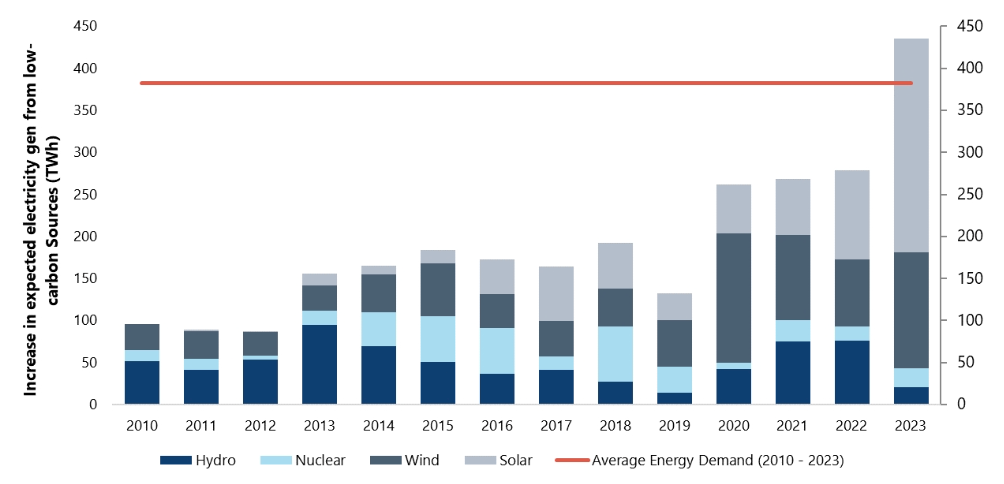

China saw a year-over-year emissions increase in 2023, but its post-COVID return to economic activity also drove significant progress in low-carbon infrastructure and technology. An impressive 230 GW of renewable capacity was added last year, and hydropower is posed for strong growth in 2024.

If low-carbon sources continue replacing fossil fuels in power generation, and incremental power demands continue to be met by renewable additions, China could enter an emissions decline for the first time in 2024.

China energy growth in China (FY ’21) will be greater than average demand.

Source: China Electricity Council (CEC), IRENA, Jefferies Research

Japanese Transition Bonds

In December 2022, the Japanese government unveiled its 10-year, 150-trillion JPY (~$1 trillion) Green Transformation Policy. Central to these initiatives is the use of transition bonds to support industry decarbonization.

Upfront investment of $20 trillion JPY of Climate Transition Bonds is intended to catalyze a public-private investment of $150 trillion JPY. Investment destinations of these bonds include non-fossil energy, industrial restructuring, energy conservation, and resource recycling and carbon reduction technologies. The first auction of these bonds, scheduled for February 14, 2024, marks a key step in Japan’s journey towards a greener economy.

India: Coal Expansion and Renewable Energy Go Head-to-Head

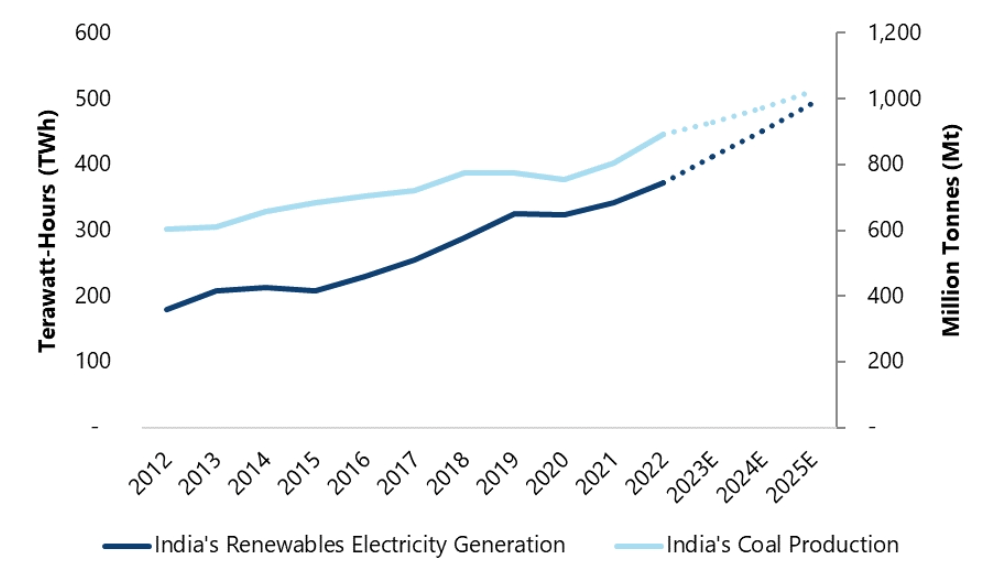

As the world pursues net-zero goals, India is in a unique position. The country can demonstrate that rapid economic growth is compatible with an ambitious decarbonization agenda.

Jefferies recently hosted investors across four states in India. The trip revealed the two competing narratives that will define the country’s trajectory:

- Growth in coal volumes will continue. Increasing power demand, established technical expertise, powerful SOEs, high utilization rates, and plants with decades of useful life remaining all mean coal consumption will increase over the next two decades.

- Simultaneously, renewables will see robust growth, given policy support and a need for energy security.

The year 2024 will be a critical indicator of how these competing forces will shape India’s energy landscape and its role in the global energy transition.

Coal production and renewable capacity additions will continue to grow in 2024 in India.

Source: IEA, Jefferies Data

Will Grid Bottlenecks Persist?

2023 marked a pivotal realization for investors, policymakers, and developers: grid bottlenecks are a critical barrier to the decarbonization of the power sector. Last summer, the Federal Energy Regulatory Commission’s (FERC) issued a new rule aimed at reforming the integration procedures for new generators into the existing transmission system.

These changes could mark an important moment for the expansion of and improvements in grid infrastructure. Faster rates of deployment could allow over 1,500 GW of wind and solar to enter capacity. The impact on the pace of the transition would be marked.

Rising Capital Costs Pose New Challenges

The energy transition faced a challenging macro landscape in 2023 The era of low-interest rates and minimal inflation, which previously bolstered the transition, gave way to a high-rate, high-inflation post-COVID world. This shift has introduced substantial challenges for low-carbon developers, impacting both renewable energy stocks and project financing.

The world will be watching interest rates and inflation closely in 2024. Continued economic tightening and elevated capital costs don’t represent a long-term impediment, but they could decelerate the shift towards cleaner energy sources in the short and medium term.

Does Carbon Capture and Storage (CCS) Deliver on its Promise?

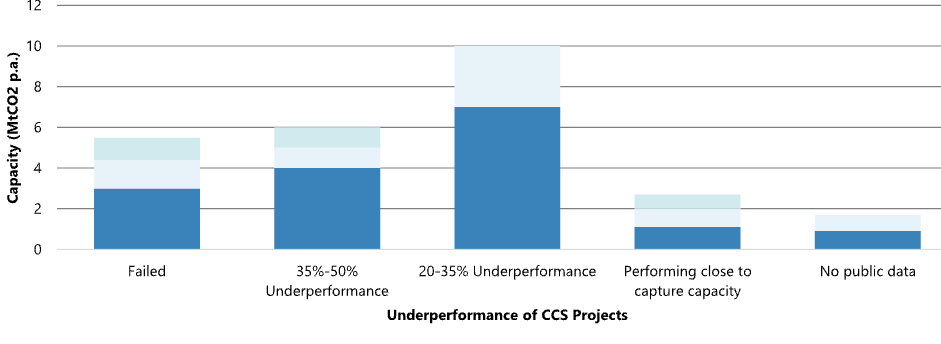

Carbon Capture and Storage (CCS) remains a topic of intense interest and debate in the energy sector. Despite high expectations and substantial investments, the performance of CCS projects has thus far been underwhelming.

Chevron’s Gorgon CCS project in Australia serves as a cautionary tale. As the world’s largest CCS facility, its performance has fallen drastically short of expectations, capturing only about half of its projected capacity. In 2022-23, Gorgon injected merely 1.71 million tons of CO2, far below its annual target of 4 million tons. This shortfall has raised serious doubts about the viability and effectiveness of CCS technology, with Chevron resorting to purchasing carbon credits to offset its deficiencies.

Santos’s Moomba CCS project in South Australia is a project to watch in 2024. With aims to store up to 1.7 million tons of CO2 annually, its success or failure will be a crucial indicator of the potential of CCS technology. A successful implementation by Santos could reignite confidence in CCS, while any shortcomings might further fuel skepticism.

Carbon Capture and Storage projects’ poor report card.

Source: Jefferies, IEEFA, The Carbon Capture Crus: Lessons Learned: September 2022

The EU Innovation Fund

The EU Innovation Fund stands as one of the world’s most significant financial initiatives to foster innovative low-carbon technologies. With a substantial budget of 4.8 billion EUR, the Fund is a cornerstone in the European Union’s strategy for a low-carbon future. Running from 2020 to 2030, it is primarily financed by revenues from the EU Emissions Trading System, potentially accumulating up to 20 billion EUR depending on carbon pricing.

The current focus of the Innovation Fund is on two key calls for proposals: the IF23 Auction for renewable hydrogen and the IF23 Call for net-zero technologies. These calls, launched in late 2023, are set to close in the first and second quarters of 2024, respectively. These initiatives represent crucial steps in the EU’s commitment to advancing the next generation of low-carbon technologies, potentially setting a global precedent for innovation in the transition to a sustainable energy future.

++

As we move through 2024, the highlighted eight key moments will critically influence the pace and potential of the global energy transition. As stakeholders and observers alike watch these events unfold, the collective actions and decisions made in 2024 will chart the course of our global energy landscape in the years to come. Follow along with Jefferies Sustainability & Transition Team for continued insights on these eight developments and more.