With over 7,000 companies – of which 100 are valued at over $1 billion – climate tech has emerged as a pillar of ESG and sustainability investing. As the energy transition unfolds, these technologies are only poised to capture more market share.

The novelty of many climate tech solutions makes it difficult for investors to assess their progress, market penetration, and impact on existing players – especially since most operate in private markets.

Jefferies’ Sustainability & Transition team set out to examine the landscape of climate tech investing; analyzing its current state, trajectory over the next year; key developments and innovations; and more.

First, it’s crucial to understand the evolution of climate tech since 2020. This period marked a significant leap forward for the sector, with over 2,500 companies raising around $150 billion through more than 4,000 deals. Acquisitions have been the primary exit strategy, accounting for 65 percent of exits since 2020. Despite macro challenges, the sector maintained its momentum in 2023, with the average deal size growing by 28 percent and investments increasing at an annual rate of 23 percent.

In 2024, as macro conditions improve, climate tech investors have dry powder. Once the domain of VC funds, the sector’s cap table now includes private equity, governments, corporates, and infrastructure funds, all ready to invest substantial capital.

Here are some of the key questions for climate investors in 2024.

What’s in store for the sector’s investment landscape?

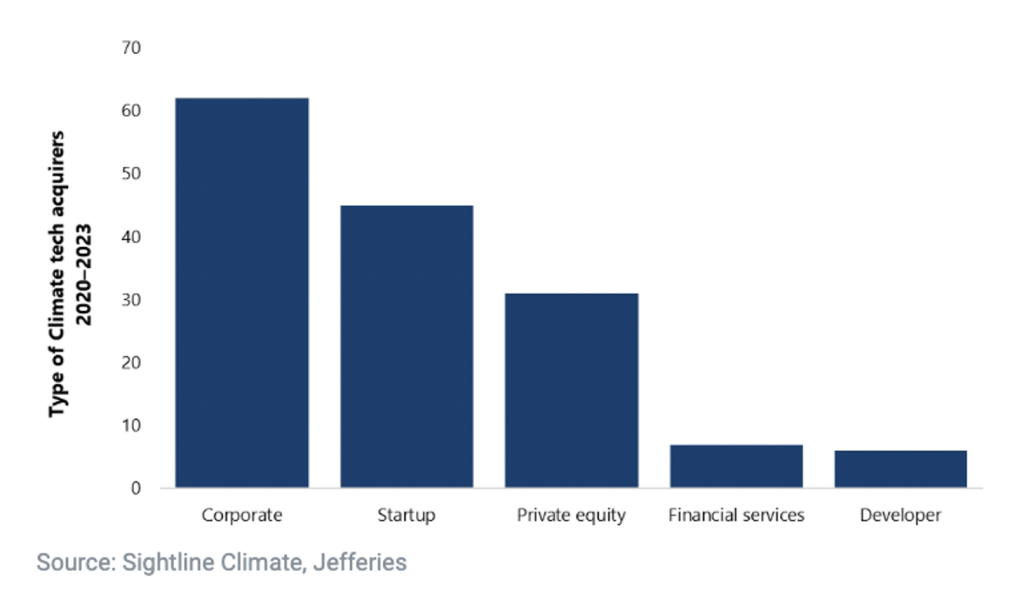

Corporate involvement in the climate tech space is expected to grow in 2024. Established corporates are likely to integrate innovative companies with limited capabilities and balance sheets, aiming to expand their market share or adjust their existing business lines.

The sector is set to mature even further, continuing the trend from 2023, with the bulk of funding flowing towards established players that offer proven solutions in specific sectors. Data indicate that Energy and Industry will be the main areas of focus for investors in 2024.

What are the size and scale of key players in the climate tech ecosystem?

Climate tech has undergone significant evolution in recent years, shifting from primarily funding innovative and immature technologies to also embracing infrastructure, growth, and bankable projects. Several factors need to be considered as investors evaluate the sector’s key opportunities in 2024:

Funding Levels: Where is capital flowing?

- In 2023, late-stage and growth funding experienced continued declines (around 30 percent), whereas seed-stage funding showed resilience, increasing by 12 percent year over year.

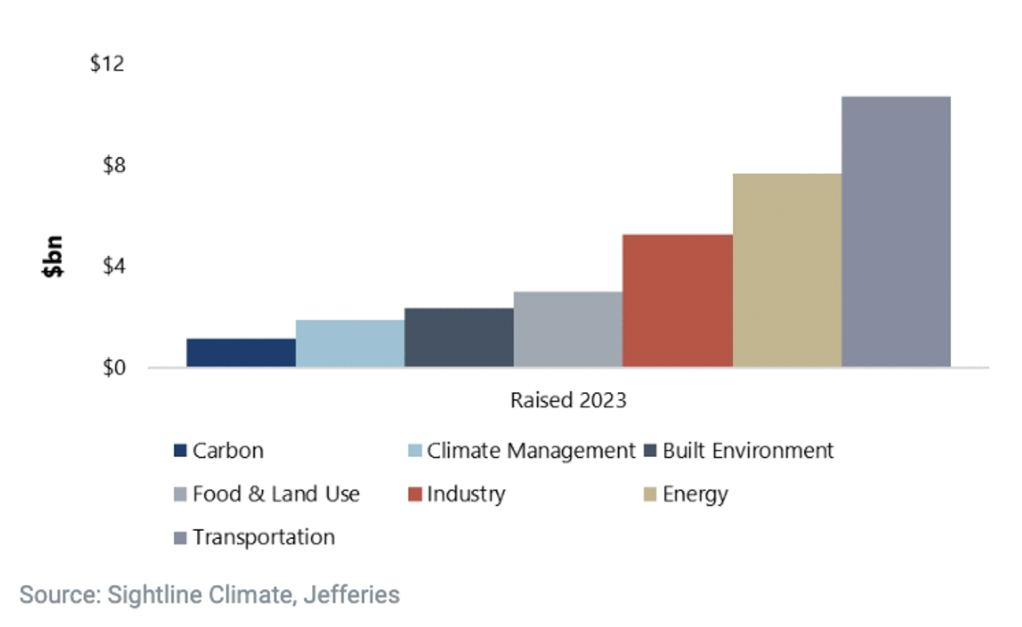

- The transportation and energy verticals remained highly attractive to investors.

- Industry was the only subsector to gain positive momentum amid a challenging macroeconomic environment.

Transportation and Energy remained in favor in 2023.

IPOs, SPACs, Acquisitions: What’s the state of dealmaking?

- Overall, IPOs, SPACs, and M&A transactions decreased by 50 percent in 2023. SPACs, in particular, saw an 89 percent downturn, signaling a potential collapse in that market for climate tech companies.

- Transportation and Energy saw the largest number of companies go public or get acquired, representing 64 percent of the sector’s total exits in 2023.

- More than 80 percent of M&A deals in the climate tech space were for undisclosed amounts.

- On average, the median exit time for companies is just north of 8 years.

Corporates & Climate Tech: How has their role evolved?

- Since 2020, corporates have emerged as the most active acquirers of companies, responsible for 41 percent of all acquisitions.

- Notably, BP, Shell, and Schneider Electric have been particularly significant players.

- Corporate venture capital has been distributed relatively evenly across Series A and growth-stage funding rounds.

Corporates have been the most active acquirers of climate tech companies over the last 3 years.

How can investors identify winners and losers in emerging climate tech sectors?

Identifying potential success stories in climate tech involves considering returns relative to the level of risk, a familiar approach for investors. Three key risks need to be assessed:

- Technology Risk: Assessing technology risk is often the single biggest issue investors face. Technology risk exists at each step through from concept to early and late prototypes, all the way to first-of-a-kind and commercial operation stages. Earlier-stage innovations naturally command higher risk premiums.

- Execution or Project Risk: With a database of over 16,000 projects globally, Bent Flyvbjerg estimates that over 90 percent of projects (construction) aren’t completed on time, overrunning by an average of 60 percent. Assessing execution risk for first-of-a-kind and one-of-a-kind projects will be a key determinant of success at both the sector level and the company level.

- Geographic Risk: The success of specific solutions will greatly depend on the local context. Some innovations may be more applicable or relevant in certain geographies than in others.

It is now widely accepted that the energy transition is a technological revolution which will play out over the next two decades — and potentially longer. It will harness the power of many new technologies, many of which are not the incumbent options in their respective sectors.

Adoption of new technologies will be both uncertain and nonlinear. Investors who are able to develop an understanding of how innovations play out at various stages will be able to develop strategies to capitalize on new markets.

For a more detailed analysis of the state of climate tech in 2024, see Jefferies’ Sustainability and Transition team’s full report on the state of the market.