The global transition towards net-zero emissions is gaining momentum, accelerated by policy incentives, the war in Ukraine, and a new wave of digital innovation. Despite geopolitical and macroeconomic headwinds, climate-related capital continues to flow into both public and private markets. Amid this dynamic landscape, investors grapple with a critical question: how to optimally allocate time and capital to emerging clean technologies.

At Jefferies, we aim to provide investors with a strategic framework to navigate this complex landscape. Our approach goes beyond merely identifying winners and losers, focusing on how to select a technology for analysis and how this selection process may evolve over time.

Climate solutions exist across a spectrum, from mature technologies to nascent innovations. Investors face a tough choice in deciding where to focus their attention. To ease this process, we have studied seven analytical frameworks for the investment community. These include (1) the scientific approach, (2) a policy-focused approach, (3) the IEA’s Energy Transitions Pathways Clean Tech Guide, (4) adoption curves and technology penetration rates, (5) the five grand challenges and green premiums, (6) the view from corporates (i.e., industry pain points), and (7) demand-side measures.

The Scientific Approach

The scientific approach is grounded in data and research from the scientific community. It particularly centers on research from the UN’s Intergovernmental Panel on Climate Change (IPCC), which ranks technologies based on their emissions mitigation potential and cost. This approach provides a data-driven frame of analysis for investors, allowing them to prioritize technologies with great emissions potential and cost efficiency.

A Policy-Based Approach

A policy-based approach leverages national roadmaps published by governments, which outline key areas of focus that will receive some form of policy support. These documents can be utilized by investors in deciding which technologies to focus on. For example, the recent UK mandate that 53% of all national emission reductions come from domestic transport is accelerating EV development and commercialization – an attractive, policy-driven opportunity for investors.

Leveraging the UK Carbon Budget

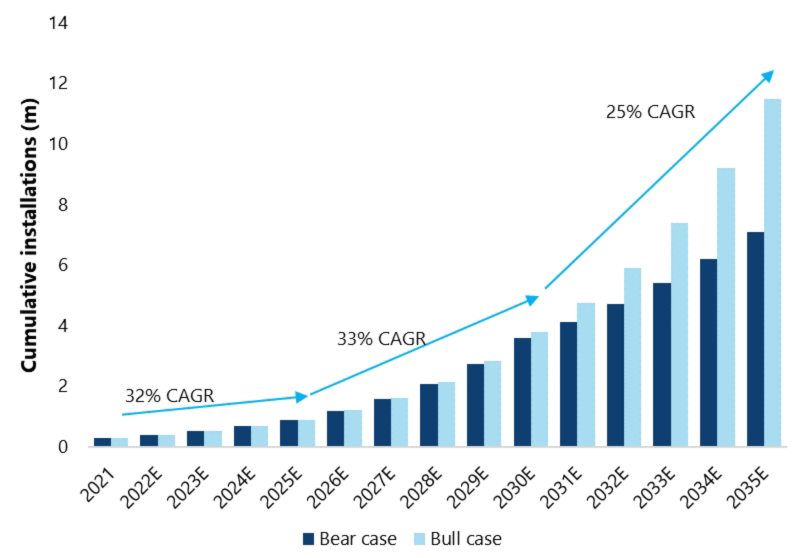

The UK’s Carbon Budget can be used to map out potential expected market sizing. Here, investors used the government’s framework to create a total addressable market for heat pump penetration (2021 – 2035).

Source: UK Carbon Budget Delivery Plan

The IEA’s Energy Transitions Pathways Clean Tech Guide

The IEA’s Energy Transitions Pathways Clean Tech Guide is an interactive framework with information on more than 500 individual technologies across the energy system, all of which would contribute to achieving net-zero. The guide provides information on the level of its maturity alongside development and deployment plans for commercial scale to be achieved. Investors can leverage this framework to gain insight into the main players in a given solution, and their anticipated trajectory of progress over time.

Adoption Curves & Technology Penetration Rates

Understanding where a technology is on its adoption curve and what the adoption rates could be moving forward is a strong basis for an investment strategy. Identifying solutions moving through the early adopters to late majority phase is a proven method for asset managers.

There are a range of factors that impact adoption speed, including the type of innovation, purchase intention data, relative advantage, strength of incumbent technologies, and the complexity of the technology. Investors should use all these indicators in assessing the adoption trajectory of a target innovation.

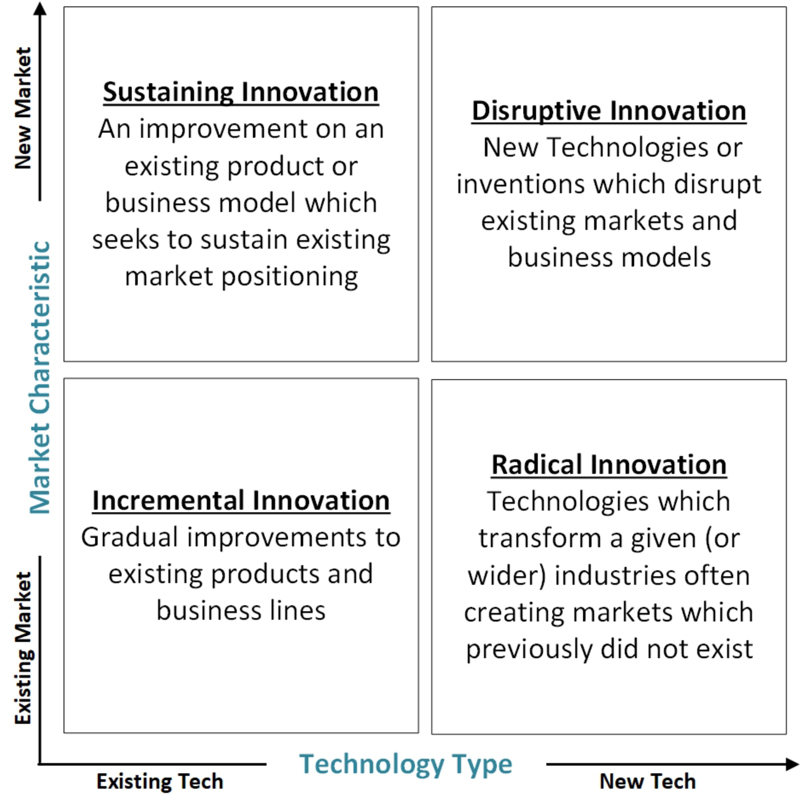

Technology Types & Market Performance

There are four main categories of innovation, and adoption and penetration rates vary widely between them.

Source: Satell – HBS, Jefferies Research

Five Grand Challenges & The Green Premium

The five grand challenges, popularized by Bill Gates in his work on How to Avoid a Climate Disaster, provide investors with a reference point with which to commit time and capital to. If addressed, these five grand challenges would reduce global GHG emissions by at least 75% through 2030, according to Climate Watch & WRI. Identifying solutions that go towards addressing these challenges is a viable starting point for investors.

The View From Corporates (Industry Pain Points)

The view from corporates, or industry pain points, is another approach for investors interested in decarbonization. Across various industries, companies face myriad challenges in decarbonizing their operations. Surveying companies and executives across sectors to understand the biggest challenges they face in reaching net-zero would lead to a subset of issues to be addressed by sector.

Demand-Side Measures

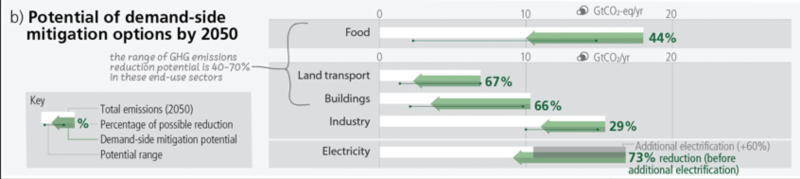

Demand-side measures, which relate to individual choices, consumer behavior, and lifestyle changes around consumption, offer another avenue for investment. The IPCC’s WG III report made clear that certain demand-focused measures would reduce emissions substantially. In many cases, business solutions can facilitate changes in consumer behavior. These may include product sharing services, alternative proteins, energy efficiency measures, and high-speed railways. Investments in innovations designed to address consumer demand can have the greatest mitigation potential.

Demand-Side Mitigation in Electrification

Demand side changes in electricity and buildings could materially reduce emissions through 2030.

Source: IPCC WGIII

—

The decarbonization landscape offers myriad of opportunities for investors, but navigating this landscape requires a nuanced understanding of the various technologies, policies, and market dynamics at play. By leveraging the seven frameworks outlined here, investors can make more informed decisions about where to allocate their time and capital. This will not only help them identify potential winners and losers in the clean technology space but also enable them to contribute to the global transition towards a net-zero future.

Aniket Shah is Managing Director & Global Head of Environmental, Social and Governance (ESG) and Sustainable Finance Strategy at Jefferies Group LLC. In this role, Aniket leads the integration of ESG and sustainability analysis within the global investment research department and engages with clients on this dynamic area of corporate and financial services.

He is an Assistant Adjunct Professor at Columbia University’s School of International and Public Affairs. Aniket is a graduate of Yale College and the University of Oxford, where he completed his PhD on the financing of sustainable development.