Nearly two years ago, Japan unveiled its Green Transformation Policy (GX), a $1 trillion plan to dramatically reduce emissions over the next decade. This initiative represents nearly three times the annual GDP investment percentage of the U.S. Inflation Reduction Act — and it aims to catalyze climate tech innovation in the world’s fourth-largest economy.

Surprisingly, GX has largely flown under the radar of institutional investors. Of the 400+ investors Jefferies recently engaged across the U.S. and Europe, only three were familiar with the plan.

Japan’s GX spans all areas of climate finance: carbon levies, emissions trading, transition bonds, and more. Given its scale — and the Japanese stock market’s outperformance over the past three years — Jefferies views it as a defining transition investment theme for the next decade.

In the coming weeks, Jefferies will outline GX’s core policies, investment tailwinds, and strategies for addressing Japan’s highest-emitting sectors. First, here are the eight things every climate investor needs to know about Japan and its approach to decarbonization.

- Japan is the world’s fourth-largest economy — at least. According to the International Monetary Fund, Japan’s $4.07 trillion GDP ranks 4th globally, behind the US, China, and Germany. Some calculations place it in 3rd.

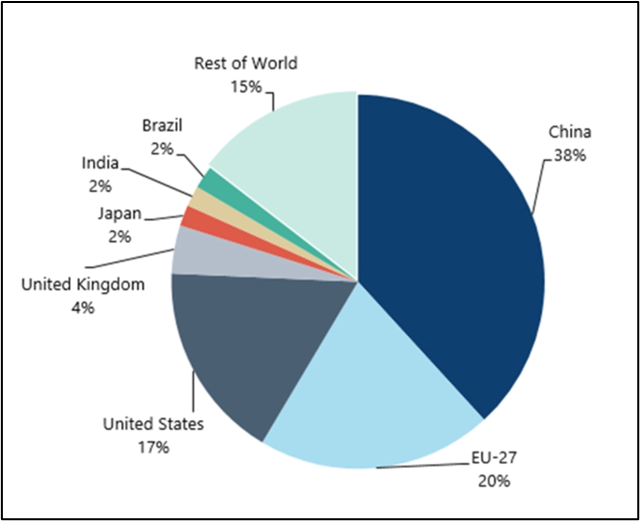

- Japan is one of the world’s leading emitters. The International Energy Agency reports that Japan accounts for 2.9% of global emissions, the 5th highest globally. Since 2000, Japan’s emissions have dropped 15%, and its emissions per capita rank 23rd worldwide — compared to China, which ranks 25th.

Despite being one of the world’s leading emitters, Japan was just 2% of the total $1.8trn spent on energy transition in 2023.

- Japan’s GX Policy represents a larger percentage of its GDP than the Inflation Reduction Act does for the US. In a recent note, Jefferies encouraged investors to look beyond the US, especially as the IRA may not survive in its current form. It is also arguably more impactful on Japan’s economy than the IRA is on the US. Annual public investment under GX is 0.33% of GDP, compared to the IRA’s 0.13%. Factoring in both public and private investments, GX accounts for 2.47% of GDP, while the IRA is 1.04%.

- Japan has set several new climate targets, including a goal for nuclear power to make up 20% of the country’s energy mix by 2040. To achieve these ambitious goals, Japan is tapping into all areas of climate finance, including bond issuance, R&D investments, subsidies, carbon levies, and an emissions trading scheme.

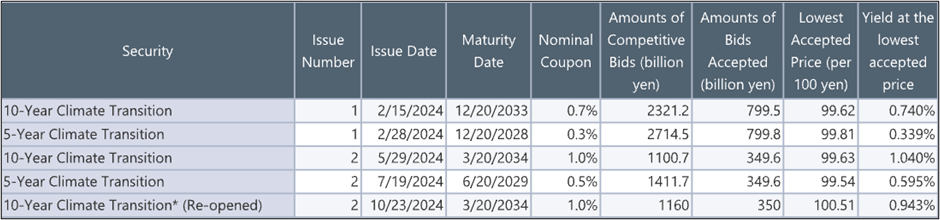

- Japan is issuing transition bonds as part of its GX vision. Japan will issue 20 trillion JPY (~$144B USD) of sovereign climate transition bonds over the next several years. In February 2024, the 10-Year Climate Transition Bond was priced at a 0.74% yield, slightly below regular Japanese 10-year government bonds at 0.755%.

In 2024, Japan issued ¥2.65 trillion (~$17B) across 5 bond auctions. The first bond auction of 2025 is scheduled for January 29.

- Japan plans to impose a carbon levy targeting fossil fuel importers. This levy will gradually increase over time, with the proceeds allocated to repaying the principal and interest of the GX Transition Bonds. Notably, Japan currently accounts for 14% of global coal imports.

- Japan’s GX League is trialing the emissions trading scheme (ETS) for high-emission sectors. Introduced in 2023, it started with voluntary participation from the GX League — a group of 747 companies accounting for >50% of Japan’s emissions. From 2026 onward, the ETS will be mandatory.

- Japan is betting on R&D to drive a carbon-neutral future. Unlike the subsidy-heavy U.S. IRA, Japan’s GX policy focuses on directly supporting R&D through the Green Innovation Fund, which is supporting innovation at the country’s leading companies. In February 2024, 55% of bond auction proceeds were allocated to R&D initiatives.

Many of the key elements of Japan’s GX Policy are still taking shape, but there’s no question this plan merits investors’ attention. Jefferies’ team will continue to monitor the decarbonization of one of the world’s leading economies — and the economic growth and innovation this strategy aims to ignite.

Follow along for more insights from Jefferies’ Sustainability and Transition Team on the Japan GX Plan and other important climate investing themes in the weeks ahead.