Jefferies ESG Strategy Team has taken a close interest in India since our founding.

Most of the world’s future energy demand will come from emerging economies. The way these countries manage their resources will be key to achieving global net-zero goals – and India’s trajectory is particularly significant.

For years, India’s energy demands have been driven by coal growth, but today, the country is quickly diversifying. As the Indian equity market nudged past the $4 trillion mark, almost tripling in value since 2020, India’s position as a rising hub for low-carbon investment and innovation cannot be overlooked.

In November, the Jefferies ESG team visited India for a first-hand look at the country’s energy and social transition. We visited four cities and states: Mumbai (in Bombay), Delhi, Ahmedabad (in Gujarat), and Hazaribagh (in Jharkhand).

The trip yielded several important insights for the global investment community about this important economy and its emerging role in sustainable investment. Below are fifteen observations from our trip.

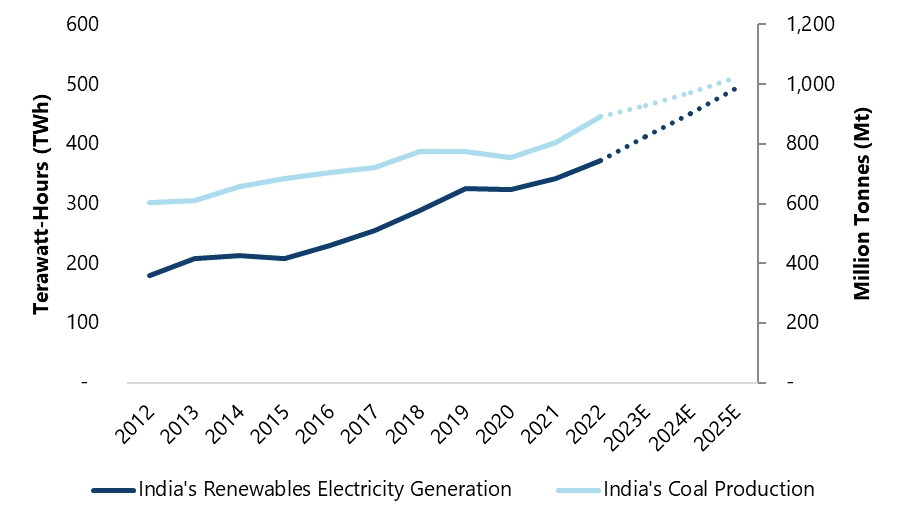

Two Competing Narratives: Both Thermal Coal & Renewable Power Generation Set to Rise

India has enough coal reserves for the next 200 years. The increasing demand for power, established technical expertise, strong state-owned enterprises (SOEs), indicate that coal consumption will continue to rise over the next two decades.

Simultaneously, the renewable energy sector will see tremendous growth in its share of the power mix. This growth will be supported by favorable policies and the country’s pursuit of energy security.

Though coal and renewables may appear to be contradictory forces, both are poised for robust growth through 2030 and beyond.

A Desire for Energy Independence

India’s aspiration for energy independence was a recurring theme during our visit. Internal coal reserves provide independence in the short term. In the medium to long term, renewables offer a path to greater energy independence, especially for sectors beyond power, such as transportation and industry.

Unwavering Policy Support for Energy Transition

Our meetings with government agencies and corporate leaders affirmed India’s unwavering policy support for the energy transition. There was no sense that current pro-renewable policies or subsidies would be scaled back, regardless of the outcome of the 2024 federal elections. This contrasts with many Western governments, where energy policy is currently dependent on the outcome of upcoming elections.

The Uniqueness of India’s Interconnected Grid

India’s Grid is one of the few in the world where new assets can be connected for transmission in 7-12 months. A singular grid, and policies which mandate the creation of high-speed networks where none exist, provide significant advantages. India’s Electricity Act should be studied by investors and policymakers around the world.

India’s Storage Options (e.g. Sodium Ion Batteries & Pumped Hydro)

Over the course of the trip, sodium ion batteries and pumped hydro were frequently highlighted as the two main alternatives to Li-Ion batteries, which remain expensive. Pumped hydro, in particular, exhibits favorable characteristics.

The Financial Health of India’s Power Distribution Companies

Entering the trip, the financial health of power distribution companies (DISCOMS) was cited as a major hurdle to renewable adoption. Their inability to competitively purchase RE power has weighed on India’s transition. We learned that policy interventions and reforms supporting DISCOMS have alleviated these concerns for generators and developers.

Self Sufficiency

Several of the companies we met are planning to expand their manufacturing capabilities down the supply chain (e.g., wafers, cells, ingots for solar panels). Driven by geopolitical concerns and external market unpredictability, both SOEs and private entities are seeking self-reliance. India aims to compete with China in green tech manufacturing – though most acknowledge it will be a decade-long journey.

National Green Hydrogen Mission

India believes that relative to China, the country was left behind on solar, batteries, and other forms of green manufacturing. India is keen to lead in green hydrogen. The National Green Hydrogen Mission, focusing on replacing significant amounts of grey hydrogen and building capacity, is central to this ambition.

The Creation of Carbon Markets

While the development of carbon markets is on the horizon for companies, it remains a medium-to-long-term consideration. The national scheme is still in early stages and is not yet significantly influencing corporate decisions. However, it is viewed as a future catalyst for making green hydrogen economically viable.

Business Strategy & India’s NDCs

Sovereign-level targets and Nationally Determined Contributions (NDCs) for India are clearly spurring action from both private companies and SOEs. As a reminder, India is planning for 500GW of installed low carbon capacity by 2030, and 50% of power gen to be from renewable sources by the same date. Those we engaged with reported strong financial positions and cash generating assets, with capital availability not an issue in allocating towards the transition. Many have and will continue to seek strategic M&A with European and US counterparts (see here and here).

Both the Private & Public Sector Are Actively Involved in Energy Transition

We met with Adani Green, Adani New Industries, and Adani Energy Solutions (all part of the Adani Enterprise Family), Reliance Industries, ReNew Power and HDFC Bank to name a few. All of these privately owned companies are actively investing in the transition.

We also engaged with NTPC, Power Grid Corp of India, Solar Energy Corp of India — Ministry of Renewable Energy. These organizations are either within the government apparatus or majority owned by the state. SOEs and state banks are clearly key drivers of India’s decarbonization efforts.

National Investment & Infrastructure Fund Limited (NIIFL)

The NIIFL is an innovative collaborative platform for pooling institutional capital in infrastructure. Its structure enables private capital to navigate local bureaucracy effectively and could serve as a model for both emerging and developed countries in funding transitions. Engaging with NIIFL presents attractive investment opportunities and a mechanism for de-risking investments.

And some signposts to track going forward . . .

New Coal Projects

Existing coal mines and power plants are unlikely to be retired early. Instead, investors should monitor when new coal projects stop being commissioned, as this will be a sign of accelerated progress towards net zero.”

Storage Costs

The price of Li-ion batteries has dropped 14% this year (c.$139/kWh). This is still not cost-effective enough for the country to capitalize on its mass solar potential. Monitoring the price of various storage options will be harbingers of further decarbonization in India.

Follow Experimentation in India

Panasonic and AES have recently announced an agreement to construct a 10MW energy storage facility in India. Many companies are also exploring sodium ion batteries. Developments in wind, pumped hydro, and hydrogen are all worth tracking. The country is at the epicenter of the growth versus carbonization challenge, and we expect innovative developments and solutions to continue emerging.