Jefferies recently wrote about Japan’s Green Transformation Policy (GX), a $1 trillion plan to dramatically reduce emissions over the next decade. This initiative represents nearly three times the annual GDP investment percentage of the U.S. Inflation Reduction Act — yet it has largely flown under investors’ radar.

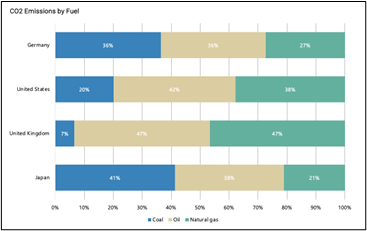

Decarbonizing Japan’s economy comes with unique challenges and opportunities. Japan relies more on coal (the most carbon-intensive fossil fuel) than its high-income peers, and a large share of its energy is imported. At the same time, Japan can draw lessons from other countries’ transition policies and emissions trading schemes, giving it a significant second-mover advantage.

Historically, Japan has lagged in energy transition investment. Last year, it made up just 2 percent of global energy transition spending, despite being the world’s fourth-largest economy. Smaller economies, including India, the U.K., and Brazil, matched or outspent Japan in 2023.

The GX plan is specifically designed to address these challenges. It targets high-emission companies with an aggressive decarbonization strategy — aimed at maintaining their economic performance and the country’s energy supply.

Here’s how it works in five key steps.

- Target Setting: Japan’s slow start in the energy transition isn’t stopping it from setting ambitious, fast-moving goals. The GX Plan aims to reshape the country’s power mix by 2040, with 40-50 percent from renewables and 20 percent from nuclear. These targets set the stage for bold policymaking and investment — detailed in the steps that follow.

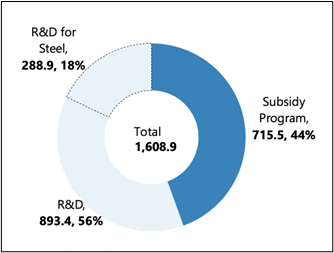

- Transition Sovereign Bonds: Between 2023 and mid-2029, Japan will issue ¥20 trillion in transition sovereign bonds. Unlike the “green bonds” of the IRA, which fund climate projects across the economy, transition bonds specifically help high-emitting companies lower emissions — moving from “brown” to “less brown” or “greener.” Proceeds will fund R&D through the Green Innovation Fund and support decarbonization efforts via the Subsidy Program, with a focus on Japan’s hardest-to-decarbonize sectors.

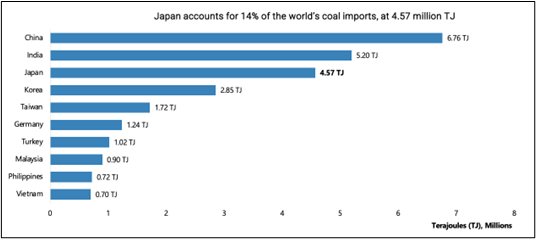

- Carbon Levy on Fossil Fuel Imports: Japan accounts for 14 percent of the world’s coal imports, trailing only China and India. Starting in 2028, it will introduce a carbon levy on fossil fuel importers, with rates increasing over time. Revenue from the levy will be used to repay the principal and interest on GX Transition Bonds. By linking fossil fuel imports to decarbonization funding, Japan is creating a built-in financial mechanism to curb coal dependence while sustaining long-term support for its transition strategy.

- A National Emissions Trading System (ETS): Japan launched its national ETS in FY2023, beginning with voluntary participation through the “GX League” — a group of 747 companies responsible for over 50 percent of the country’s GHG emissions. Notably, 18 of the 20 highest-emitting Japanese stocks (Scope 1 + 2) have joined. This voluntary phase runs through FY2025 before transitioning to a mandatory ETS in 2026. Japan has the opportunity to learn from the successes of ETS efforts in Europe, China, and beyond. More details on its plan will be released this year.

- An Innovation-First Approach to Climate Policy: Japan’s GX Plan prioritizes research and development in addition to subsidies — a strategy aimed at positioning the country as a global hub for climate tech and clean energy innovation. More than half of the transition bond proceeds will fund R&D through the Green Innovation Fund. The plan also dedicates JPY 200 billion over five years to deep tech startups and JPY 700 billion to support small and medium-sized enterprises driving the energy transition.

This chart illustrates the use of proceeds for the February Bond Auction (representing 1.6T JPY of the total 20T JPY to be issued).

Japan’s decarbonization path comes with unique challenges—but it’s being tackled with an equally unique strategy.

The scale and structure of the GX Plan—its incentives, R&D focus, and diverse climate finance tools—set Japan up for one of the most ambitious energy transitions in the developed world. Jefferies, and investors everywhere, should keep a close watch.

Follow along for more insights from Jefferies’ Sustainability and Transition Team on the Japan GX Plan and other important climate investing themes in the weeks ahead.