The energy transition has been picking up steam for a while. But a confluence of new factors has the potential to further accelerate growth and create unusually promising investment opportunities for private equity.

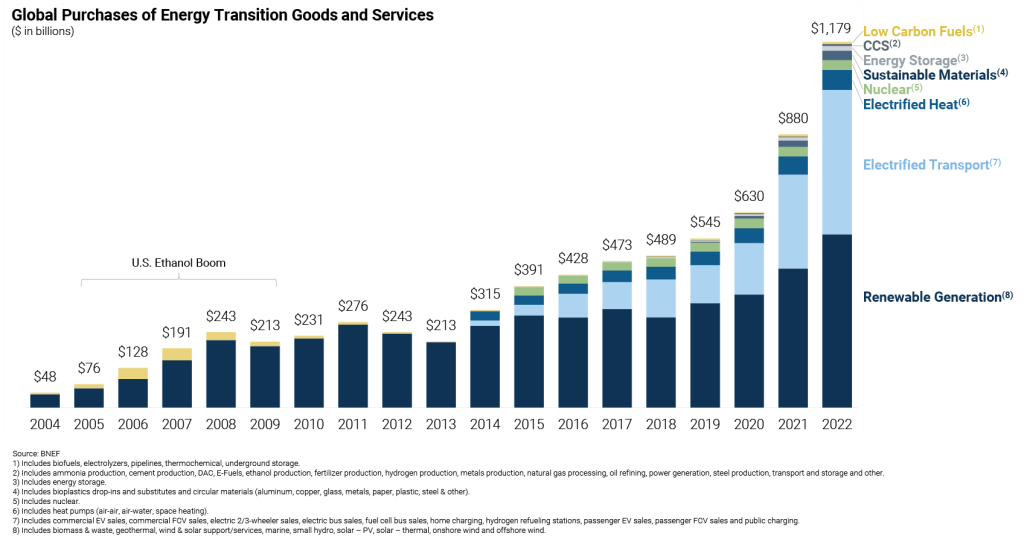

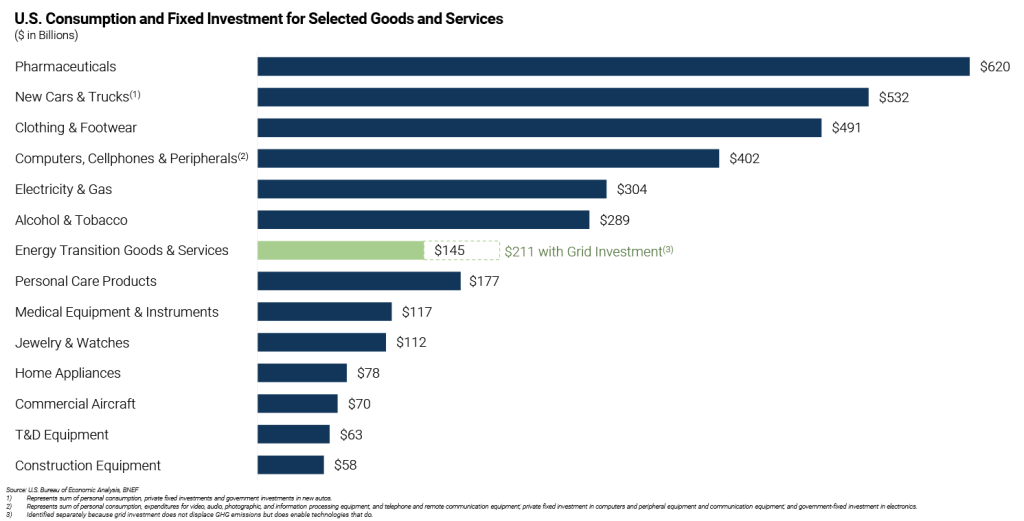

Last year, global spending on energy transition goods and services was nearly $1.2 trillion, representing a five-fold increase from a decade earlier. The U.S. market was $211 billion (including investment in the power grid) making it a little more than half the size of the electronics market (smart phones, computers and peripherals); nearly twice as large as the market for medical equipment; and three times larger than the market for commercial aircraft.

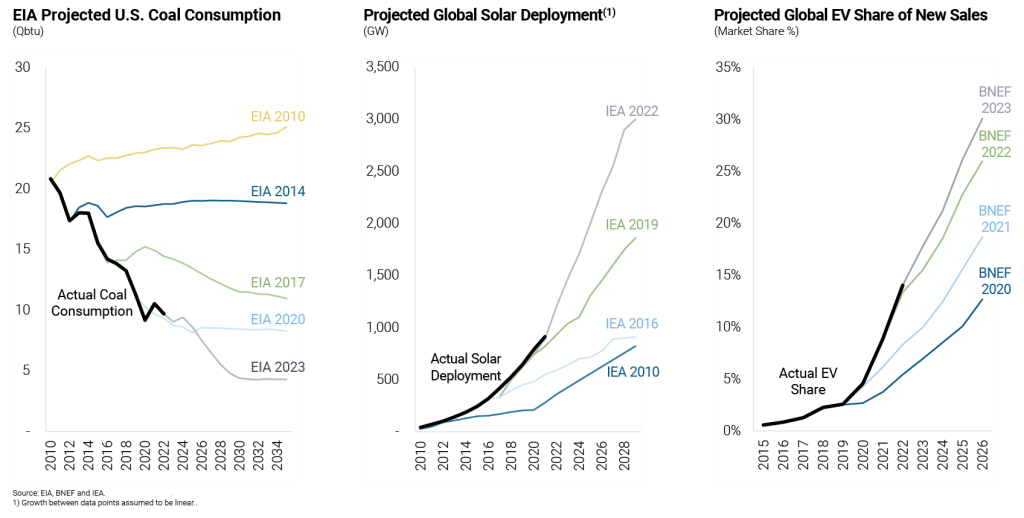

Since 2010, experts’ projections have dramatically underestimated the speed of the energy transition and the size of the markets for related goods and services that it would create. Forecasts for everything from coal consumption to global solar deployment to electric vehicle sales were way off.

Forecasts may again be too conservative for four reasons:

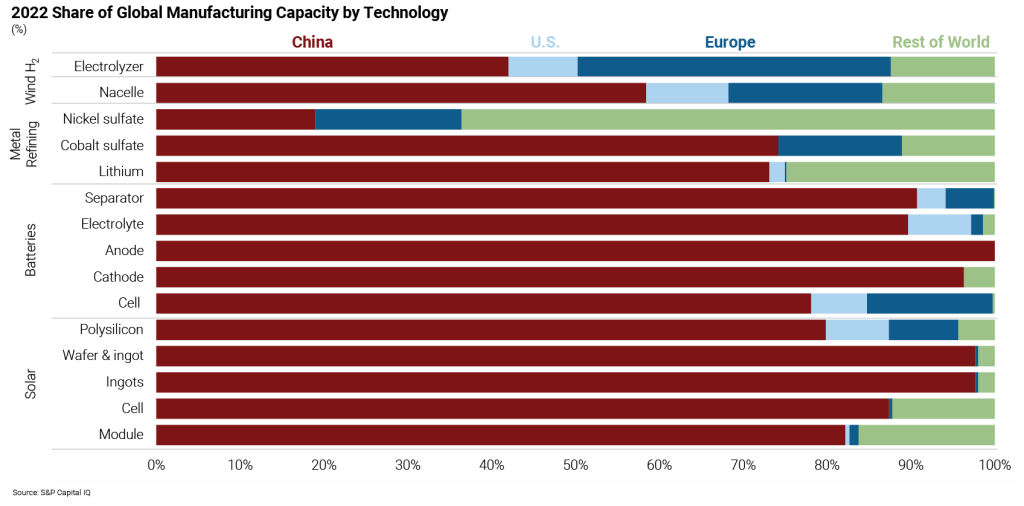

New Wave of Cost Reduction Driven by Onshoring: The cost of solar modules, wind turbines, and batteries as well as many other energy transition technologies has been falling for decades. This has made them increasingly competitive – if not less costly than – conventional solutions. But most of the reduction over the past ten years has come from economies of scale rather than breakthroughs in technology or manufacturing methods. That has in part been due to most energy transition products being manufactured in China, which has a long track record of reducing costs through production efficiencies rather than technological innovation. With the U.S. government recently passing the Inflation Reduction Act, CHIPS Act and Infrastructure Investment and Jobs Act, there are tremendous incentives to bring manufacturing, particularly of energy transition related products, back to the U.S. While most experts see more goods being produced in the U.S. as a result, they haven’t factored in the innovation that will likely come from large-scale manufacturing of energy transition products in the U.S. and its potential to accelerate cost reduction and adoption.

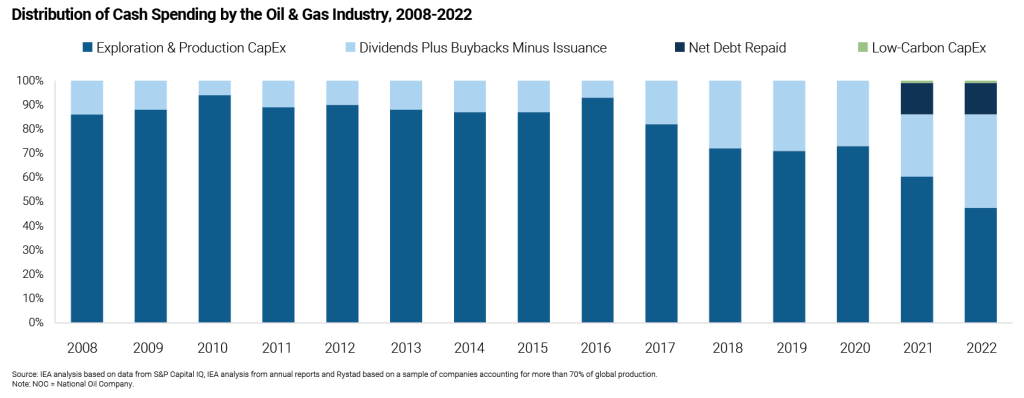

Higher Prices for Fossil Fuels: Energy companies are paring back investments in production despite record cash flows. Less than half of the record free cash flow that oil and gas companies are generating is being invested in new supply. Instead, they are plowing that money into stock buybacks, dividends and debt repayment. The underinvestment in exploration could mean much higher prices for fossil fuels in the future. That, in turn, should make energy transition technologies that are being worked on now more competitive on a relative basis even without further cost reduction.

National Security Imperatives: In the past, the primary driver of policy support for the energy transition was fighting climate change. But the war in Ukraine added a new one for many governments – national energy security. Every country has renewables (the sun shines and wind blows everywhere) but only 20% of people live in countries with sufficient fossil fuel supplies to meet their energy needs. The attractiveness of renewables from a national security perspective is that every country has them and no one can take them away. The E.U. has redoubled its support for renewable energy in the wake of Russia’s invasion of Ukraine, which underscores how powerful the national security imperative can be in driving incremental policy support for the energy transition.

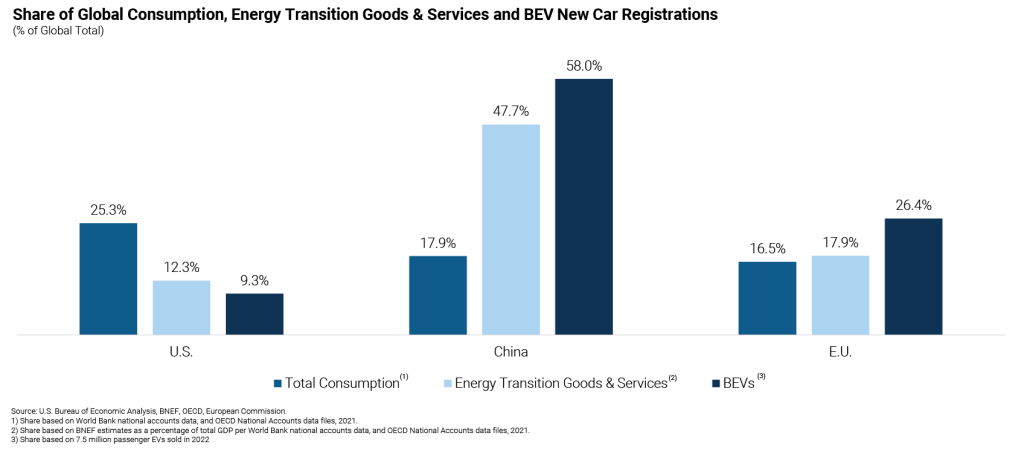

Outsized Growth Potential in the U.S.: The U.S., with just 4% of the world’s population, consumes a disproportionate share (25%) of just about everything in the world – except energy transition goods and services. The U.S. is a significantly smaller market for energy transition goods and services than the E.U. or China, consuming only about 12% of energy transition products produced globally and just 9% of all electric vehicles. In fact, China and the E.U. consume energy transition goods and services at 2.7x and 1.1x the rate that they do all goods and services, respectively. If the U.S. were to consume energy transition related goods and services at the same rate that it does all good and services, the U.S. market would more than double in size. There is a good chance this will happen, as there is no reason why the U.S. should be so far behind China and the EU in its consumption.

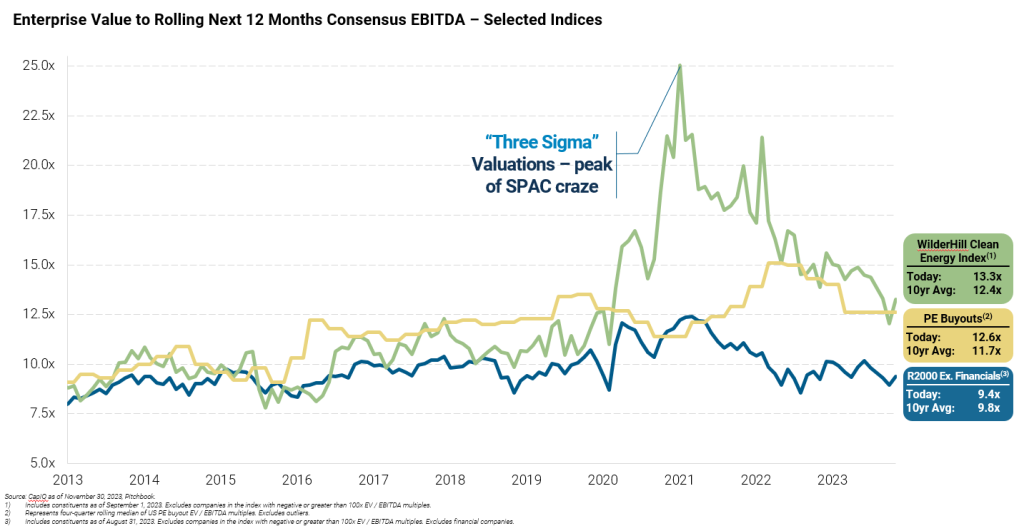

An Emerging Opportunity for Private Equity: At the same time as these new drivers are emerging that could accelerate growth, public market valuations for energy transition companies have compressed dramatically. The median company in the Wilder Hill Clean Energy index, one of the most widely followed indices of energy transition companies, currently trades at a multiple of just 13.3x next 12 months consensus EBITDA which compares to 25.1x at the index’s peak in Q1 2021 and 9.4x for the median company in the Russell 2000 today – which has lower growth prospects and is more sensitive to GDP growth.

The potential for faster growth in energy transition markets coupled with historically attractive valuations creates a very attractive risk/reward opportunity. It’s rare for growth prospects to be improving at the same time as valuations are compressing. Private equity should take note.

David Dolezal is Jefferies’ Global Head of Energy Transition Investment Banking where he is responsible for leading the firm’s coverage of companies in the solar, wind, electric vehicle, energy efficiency, energy storage, biofuels, advanced nuclear, fuel cell and sustainability consulting and software subsectors. David has more than 25 years of experience advising companies and investors on financing and M&A. He has completed more than 100 transactions for both Fortune 500 and middle-market companies, including leading three of the five largest cleantech IPOs in history (Array, Shoals and GT Solar), two of the three largest PIPEs into energy transition companies in history (IEA/Ares and Array/Blackstone), the largest sale of a renewable power company to an oil & gas major in history (Savion/Shell) and the largest sale of an energy-as-a-service company in history (Budderfly/Partners).

Kyle Baker is Jefferies’ Head of Energy Transition Investment Banking, Americas and directs the overall coverage effort alongside David Dolezal. She delivers sector expertise to financial sponsors with energy transition investment mandates and brings nearly two decades of investment banking experience covering sectors related to sustainability and energy services in both the U.S. and Europe.