Specialty finance companies experienced positive momentum during the second quarter and summer of 2023. Sustained demand for credit from both consumers and alternative funding, along with some encouraging macroeconomic trends, drove continued growth.

Inflation and heightened borrowing costs may continue to trouble consumers, a robust labor market and rising wages set the stage for sustained consumer spending through year’s end.

Consumer Credit Dynamics

Credit card demand maintained its strong pace, with balances surpassing $1 trillion in the second quarter of 2023. Personal savings remain low and the cost of everyday expenses high, forcing consumers to lean heavily on credit.

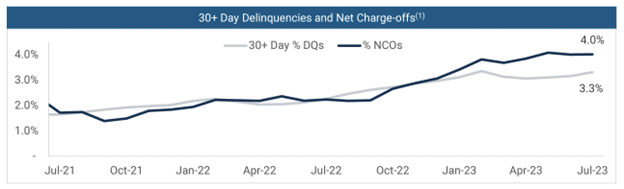

Many Americans amassed savings during the pandemic, but those reserves are running dry. The Federal Reserve of New York reported that delinquency roll rates for credit cards and auto loans now slightly surpass pre-pandemic levels. A robust labor market and rising wages continue to fuel strong consumer spending, but as inflation persists and student loan payments resume, consumers may struggle to meet their obligations in the months to come.

These concerns came to a head in August, when Macy’s announcement caused ripples in consumer finance stocks. The company, a major issuer of credit cards and layaway programs, is often a barometer for consumer credit health. Macy’s highlighted a material decline in credit card income, attributed to elevated delinquencies across its portfolio. The rapid rise in delinquencies surpassed expectations, hinting at increased consumer distress.

New data from the Federal Reserve show credit delinquencies this summer reached rates not seen since 2019. The rate of debt unpaid after 30 days escalated to 7.2% – the highest since 2012.

Alternative Funding Partners: The Rising Stars

Summer 2023 saw a continued shift in the landscape of consumer loan funding. Traditional funding partners like banks and credit unions are stepping back amid liquidity constraints, setting the stage for alternative credit managers. The $700 million joint deal between Castelake and Neuberger Berman with Oportun is testament to this trend.

Other ventures, including Castelake’s agreement to acquire up to $4 billion of consumer installment loans from UPST, reinforce the increasing presence of alternative funding partners. With consumer loan assets offering a tempting return profile, these funders are well-positioned to bridge the gap left by wider banking retreats.

Mixed Macroeconomic Indicators

In the broader economy, unemployment levels hover near historic lows, and inflation shows signs of cooling. Nonetheless, daily household goods still command higher prices, and consumers are feeling the crunch.

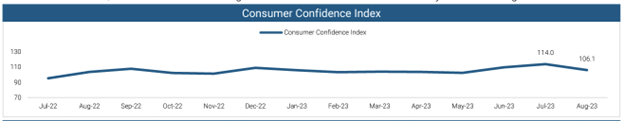

Student loan payments are slated to resume in October, and signs of consumer anxiety have reemerged. The mix of positive job and wage data with negative consumer sentiment place renewed pressure on the Federal Reserve, as it weighs next steps.

The Consumer Confidence Index, after reaching a high of 114.0 in July 2023, dropped to 106.1 in August. Economists had projected the index to rise to 116 this month, making this decline especially notable.

In the banking sector, the impact of 2023’s four major failures continue to be felt. Following the credit downgrades of several banks in August, Fitch announced that the industry was inching toward another downgrade from AA- to A+. Liquidity constraints remain a concern for the US banking sector, and Fitch warned that the operating environment will likely remain challenged in the medium term.

A Sector Set for Growth

The blend of mixed macro signals and a tentative consumer environment might spell uncertainty, but the consistent demand for credit, bolstered by alternative funding partners and fintech, promises to sustain positive momentum in the specialty finance sector. In the intermediate term, issues and investors alike will remain focused on specialty finance companies, particularly as the broader economic climate and state of the consumer continue to evolve.