The sleep apnea treatment landscape experienced a major reshuffling in 2021, as Philips Respironics, a longtime market leader, recalled several CPAP and BiPAP devices due to potential health risks. Now, three years later, Philips is preparing to re-enter the market. What does this mean for companies like ResMed, who stepped in to fill the gap Philips left behind?

This is just the tip of the iceberg in what’s expected to be a critical year for the sleep apnea sector. The advent of GLP-1 drugs brings further uncertainty. These novel treatments have the potential to alleviate sleep apnea symptoms, but their impact on the market is yet to be seen.

In a recent survey of 50 US-based sleep doctors and durable medical equipment (DME) providers, Jefferies’ Global Research and Strategy Team explored these developments and more. Respondents shed light on the current and future market for sleep therapies, from the resilience of established methods like CPAP (Continuous Positive Airway Pressure) to the emerging potential of GLP-1 Agonists.

Here, we unpack the latest trends in pricing, product quality, and novel therapeutic approaches that are shaping an eventful 2024 for the sleep apnea treatment market.

The Competitive Landscape: How Will Philips’ Re-Entry Impact the SDB Treatment Market?

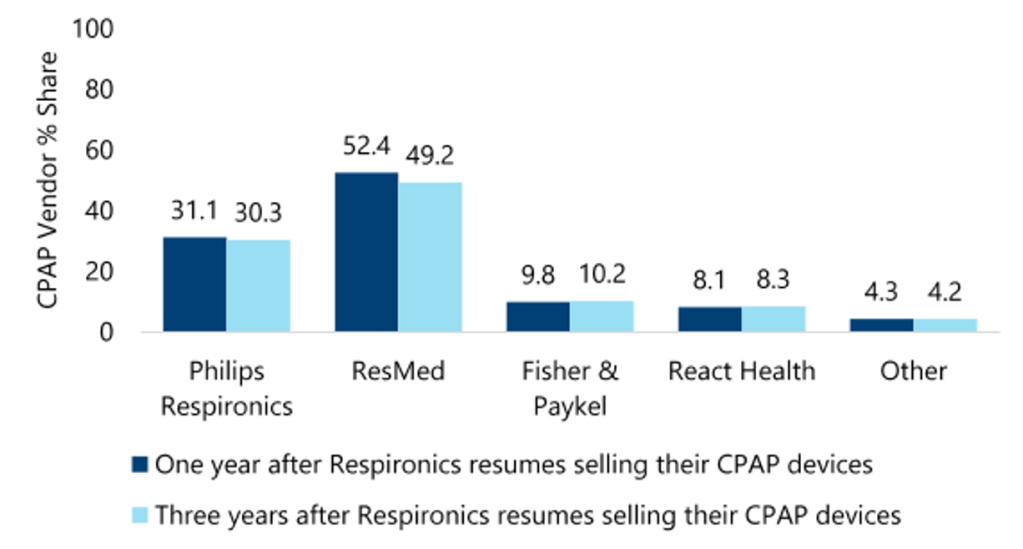

ResMed, the market leader, scored highest in providers’ CPAP and mask rankings. RMD currently holds 62 percent market share, a position strengthened by Philips Respironics’ exit from the market in 2021. This shift came after issues were discovered in Philips’ CPAP and BiPAP devices, leading to a market gap that RMD effectively filled. Despite its strong position, respondents expect RMD’s market share to decrease with Philips’ re-entry, potentially falling to between 49 and 52 percent in the next 1-3 years.

Exhibit 1 – What percentage of your CPAPS do you expect to write scripts for or recommend patients use from the following providers?

Source: Jefferies 4Q23 Sleep Survey

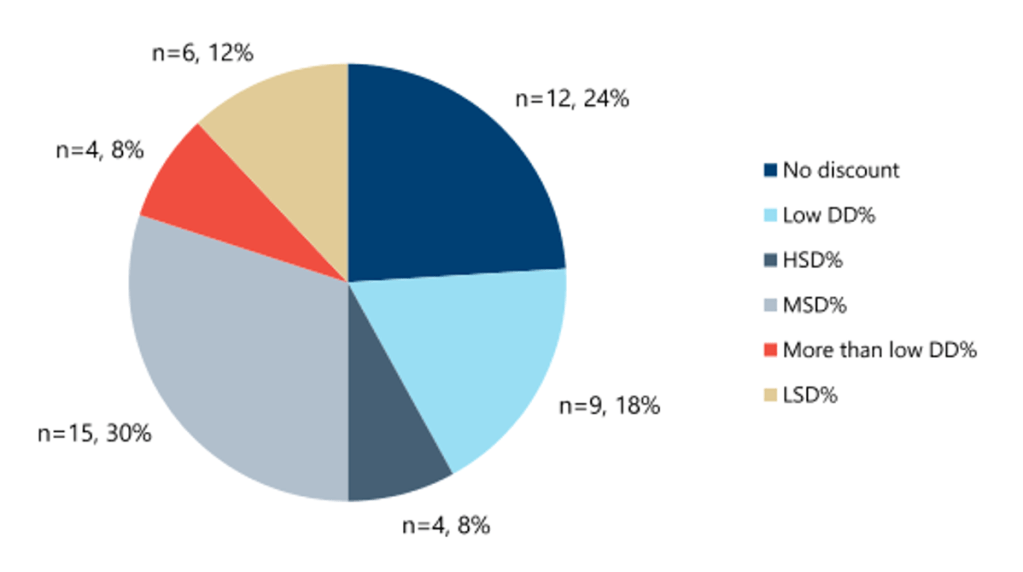

The exact timing of Philips’ return to market is still pending, dependent on the outcome of a consent decree. However, respondents expect PHIA’s re-entry to include competitive pricing strategies, with moderate discounts aimed at RMD. While PHIA is expected to regain market share, the process is likely to be gradual, buffeted by the company’s reputational challenges and an increasingly tough competitive landscape.

Exhibit 2 – Assuming Respironics can prove the safety of their machines, what level of pricing discount would you insist on from Respironics (expressed as average % discount vs ResMed)?

Source: Jefferies 4Q23 Sleep Survey

Looking ahead, respondents also expect scripts for Fisher & Paykel and React Health to increase in the coming years, by 4.1 and 3.0 percent, respectively. Both companies benefited from the initial PHIA recall, with their market share rising by several percentage points.

The Birth of GLP-1s: Do Weight-Loss Therapies Threaten the Industry’s Gold Standard?

Though respondents expect continued growth in the CPAP market, this growth faces potential slowing due to the rise of GLP-1 treatments. GLP-1 Agonists, primarily used for obesity management and diabetes, show promise in reducing sleep apnea symptoms by promoting weight loss, a known factor in improving sleep apnea severity.

Survey participants predict a 12 percent increase in CPAP volume for 2024, with GLP-1 treatments having a limited impact initially. However, over the next five years, they expect the CPAP market could shrink by approximately 15 percent as a result of these treatments. To date, there hasn’t been a noticeable decline in adherence to or sales of traditional sleep apnea treatments among patients using GLP-1 treatments, but changes are expected as the market adjusts to these new therapies. Leading CPAP providers like RMD are yet to feel a significant impact but are preparing for future shifts in the market influenced by these novel therapeutic options.

Jefferies’ Sleep Survey offers important insight into shifts in the sleep apnea treatment landscape, as key players like ResMed and Philips navigate periods of transition. The coming years may see changes in market share, competitive pricing dynamics, and the integration of novel therapies like GLP-1 agonists, presenting unique opportunities and challenges for investors, healthcare providers, and patients. Jefferies Global Research and Strategy team will monitor these developments closely; the full summary of the sleep doctor and DME provider summary is available here.