In 2024, 338 companies went public on the National Stock Exchange of India (NSE) and BSE, raising a record $21 billion. By year’s end, India was one of the world’s hottest IPO markets, with its volume matching the combined total of China and Hong Kong.

More recently, though, Indian public markets have lost steam. The Nifty 50 index, which tracks the country’s top-50 public companies, initially dipped on concerns over the Trump administration’s anticipated tariffs and continued to slide as more details emerged.

What does this mean for public offerings? It may be too soon to tell, but some investors view current IPO aftermarket performance as a warning sign. More new listings have struggled than succeeded in recent months.

Jibi Jacob, Head of Equity Capital Markets at Jefferies India, believes that broader market conditions—not IPO pricing or quality—are to blame.

“India’s market cap. has decreased from $5.5T to $3.7T, and IPOs feed on what is happening in secondary markets,” he said at a recent conference. “But if you look at the top 20 IPOs, mean returns are 25-28%. If pricing were wrong, returns would be more negative.”

Jefferies Insights caught up with Aashish Agarwal, the firm’s India Country Head, to discuss the country’s IPO pipeline. This follows his Q&A last fall, where he spoke about India’s growth story and the backlog of large companies eyeing public offerings.

Jefferies was recently recognized as India’s ‘Best Investment Bank’ by Global Finance.

India’s IPO Pipeline: Crowded but Stalled

Before analyzing the current market, it’s helpful to look back at recent trends in Indian public issuances, which, until November 2024, had ranked among the world’s most active.

In 2023 and 2024, Indian IPOs grew in number but even more in scale. Public issuances rose 22.6% from 2023, while fundraising volumes jumped 139%.

In 2023, small- and medium-sized enterprises led the IPO surge, nearly tripling new issuances from the year before. By 2024, larger companies entered the mix, and going into 2025, several of India’s unicorns were expected to go public.

Now, the outlook for large-cap IPOs is uncertain. No “mainboard IPOs”—listings from large, established companies—have launched for four consecutive weeks. New issuances have primarily come from the small and mid-cap segment.

“Though we have not seen sizable IPOs in the last few weeks, year to date nine companies got listed and cumulatively raised $1.8B. In the last two months or so, when the market has seen corrections, there are eight or nine issuers who have mandated banks for their potential listing with issue size greater than $1Bin the next 12 months,” Agarwal explained. “Since IPOs take 6-9 months for listing, being in the state of readiness is the key right now.”

A growing backlog of high-profile businesses has been cleared for public issuance but remains on the sidelines for now. So far, 34 companies have received approval to raise $4.8 billion this year, while another 55 are awaiting clearance for up to $11.4 billion, according to a leading Indian brokerage and asset management group cited by the Financial Times.

Has IPO Pricing Run Too Hot?

For two years, companies have capitalized on strong valuations in India’s public markets, which have become some of the most expensive globally by price-to-earnings multiples. The 2024 hot streak of IPOs added to the appeal. A study of 162 IPOs last year found that more than 82% traded higher after listing.

This stood in contrast to IPO markets in the U.S. and Europe, where new listings have struggled for years.

Some investors are asking if valuations have overheated. Reuters recently highlighted India’s largest IPO of 2024—a subsidiary of Korea’s Hyundai Motors. While the parent company trades at a 3.7x forward price-to-earnings multiple, its Indian subsidiary trades at 22x. Indian units of Japanese and European companies have seen similar valuation premiums.

Are 2025’s IPOs struggling in aftermarket trading due to inflated valuations, or is their performance simply mirroring broader market declines driven by tariff threats and other pressures?

“The two sizable IPOs of this year, Dr. Agarwal’s Health Care ($350 M) and Hexaware Technologies ($1B), have stood the test of recent market volatility. Both are above their issue prices currently,” Agarwal said. “We believe the aftermarket performance of 2024’s IPOs is currently driven by broad market performance and outlook.”

A Necessary Reset for Indian Markets

Some financial leaders see reason for optimism in India’s market performance, including Jefferies India’s Head of Research, Mahesh Nandurkar. In a recent appearance on CNBC India, he points to signs of stabilization in Indian benchmark indices and describes the recent downturn as a necessary reset.

“This much-needed market correction is now, I think, behind us,” he said. “Valuations are now down closer to long-term averages, and fundamentals are showing signs of improvement.”

His remarks come at a time of heightened volatility for U.S. public equities. Historically, turbulence in the U.S. has rippled into emerging markets—but this time could be different.

Nandurkar thinks the extended bull run in U.S. equities may have dampened investor appetite for emerging economies. Now, with uncertainty around tariffs and trade policy weighing on the U.S. economy, American investors may start looking elsewhere for returns. India could stand to benefit.

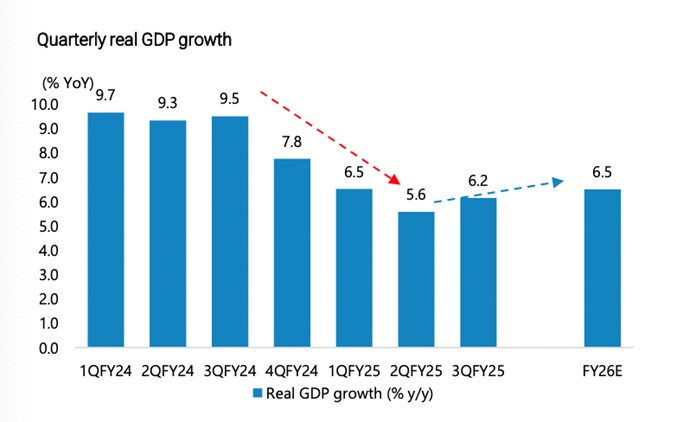

Source: MOSPI, CEA, Jefferies

Growth projections for the Indian economy reflect this. After the shallow slowdown of recent quarters, GDP growth is expected to rebound to 6.5% CAGR.

The panel cautioned that it’s too soon to call the trajectory of Indian public markets. But if the correction is truly in the rearview, it could set the stage for a stronger IPO pipeline.

Searching for Growth in Emerging Markets

As IPO activity lags in developed markets, investors are turning to emerging economies for opportunities. Indian public equities may be expensive, but they’ve delivered strong returns for years.

The question now is whether the recent IPO slowdown signals a deeper shift or just a temporary setback. With several high-profile companies still waiting to go public—and fresh positive signs for India’s economy—many eyes will be on India’s markets in the weeks ahead.

For more insights from Aashish Agarwal and Jefferies’ award-winning India team, read his Q&A on Jefferies Insights: What Will Drive India’s Growth for the Next 20 Years?