The Missing Middle

We discussed with leading VCs, growth & infrastructure investors, investment bankers and companies one question for the transition moving forward — How will climate tech companies scale and cross The Missing Middle?

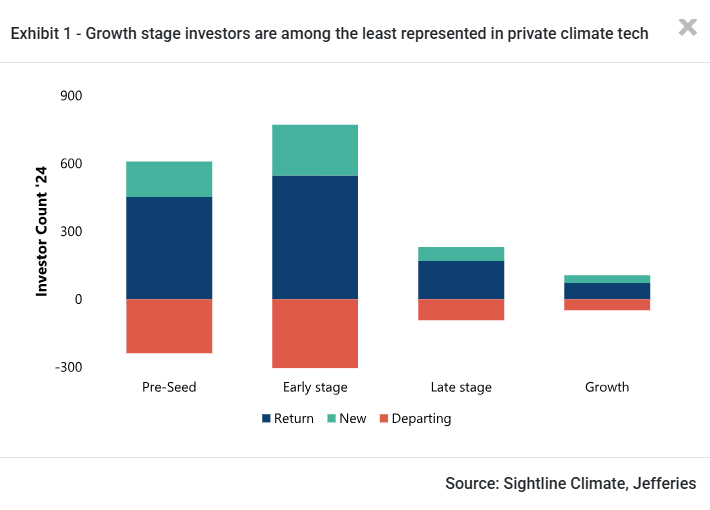

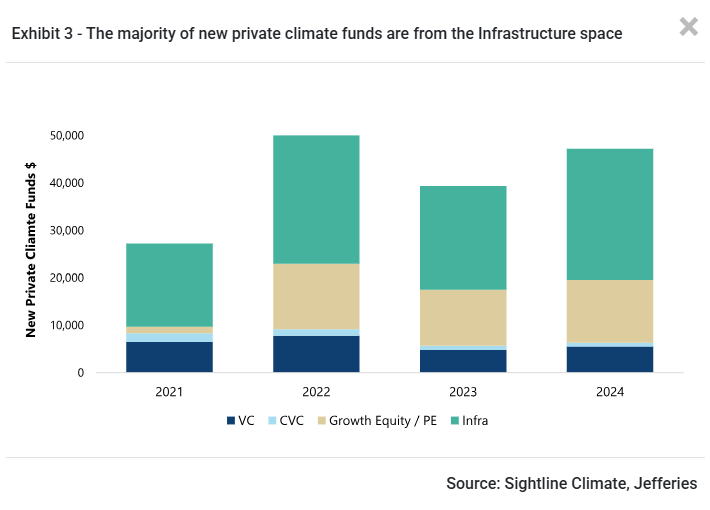

Despite global investment in the energy transition hitting $2.1trn in 2024 (up 11% YoY), the transition is not sufficiently capitalized. A closer look at the current composition shows an inappropriate mix – broadly characterized as climate tech’s ‘missing middle.’

Beyond Just Capital

In addition to a clear capital gap, the missing middle is also collection of issues all of which inhibit and prevent the scaling of late stage companies. We outline a few of those issues top of mind for companies based on our conversations.

Progress on the Missing Middle

The missing middle issue has been known for sometime. Recent years have seen investors and companies evolve in their approach to addressing these issues. We set out in detail, the current state of the market and how things have progressed in recent times.

Government Support

As companies hit the inflection point where risk/reward is an issue, the state is key (e.g., Tesla $0.5 billion and Redwood Materials $2 billion).

Strategics

Corporates can provide a “credentialing” impact and, in some cases, offtake…

Offtake

Ensuring:

1) A credible offtake at compelling prices

2) Sufficient flexibility

Public Markets

Companies, such as TSLA, ESS and RIVN, accessed public markets, in part to enable scale.

There is a financing and product gap for late stage and growth companies across the energy transition. There is a dearth of growth equity/debt investors, while companies are unappealing to infrastructure/project finance-based investors. This impedes scaling for several businesses.