Dear Clients, Fellow 5,000 Employee-Partners and Significant Others, Friends and Everyone Else Who Has Contributed To Building Our Very Real Wall Street Firm,

Yesterday (October 2), marked 60 years since Jefferies was founded essentially in a telephone booth at the Pacific Coast Stock Exchange by a person with boundless energy, vision and drive: Boyd Jefferies. We are beyond thrilled and proud of how far our Firm has come in a mere 60 years, so please indulge us with this note as we talk a little bit about our journey and how Jefferies arrived at what we believe is an incredibly envious place exactly 60 years later. The decades brought constant change, periods of calm and moments of incredible volatility, changes in technology and regulatory winds, and sudden and surprise shocks to the entire system. Here is a very brief synopsis of our Firm’s evolution:

1962-1987: Jefferies was started with $30,000 in borrowed capital and became a successful trader and pioneer in the “third market,” trading listed securities directly between institutional investors in an over-the-counter style that provided liquidity and anonymity to buyers and sellers of equity blocks. The Firm grew over these years, but from the start always prioritized clients to best serve their interests. The Firm was imbued with an incredibly entrepreneurial culture as the trading floor was commission-based and as the founder always said, “the sky was the limit.”

1987-2000: Jefferies continued its entrepreneurial ways but began the long road to diversification in order to better serve clients and increase our reach. Roughly 50 people, including one of us, joined immediately after the closing of Drexel Burnham Lambert. This marked the beginning of high yield trading, an embryonic research presence and eventually the beginning of our investment banking effort. During this period, Jefferies also established what would become Investment Technology Group, an electronic trading business that was spun off to shareholders as a separate public company during this decade. In 1990, Jefferies was proud to achieve record earnings of $7 million.

2000-Today: Jefferies entered the millennium with a market capitalization of roughly $500 million and embarked on an ambitious and aggressive plan to become a full service, global investment banking firm. First, we moved our headquarters from Los Angeles to NYC. Industry-focused investment banking became our core strategic priority, supported by a global sales and trading business and the beginning of true world-class research. We heavily diversified our products and services within sales and trading and began in earnest to build a global footprint. We started building a significant permanent capital base, established in 2004 the leveraged finance lending platform that we named Jefferies Finance, and most importantly continued to build upon our strong and talented base of human capital. We have now spent almost a decade merged with Leucadia National Corporation, a famed investment holding company, that allowed us to invest heavily in our strategy and eventually re-emerge with an ample capital base that has enabled us to prudently accelerate our growth.

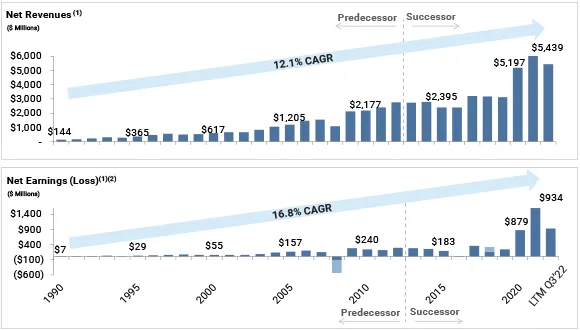

Revenues and Earnings Since 1990 – Jefferies Group

Today, Jefferies is among the world’s leaders in virtually everything we provide our clients. In investment banking (our largest business), in our latest fiscal quarter ended August 31, 2022, we were one of the top five in the world in providing merger and acquisition, equity capital markets and leveraged finance services to our clients (source: Dealogic). At the same time, our research, equities sales and trading, and fixed income efforts are also among the leaders on Wall Street. Our global revenues for the last 12 months were $6.4 billion and our net earnings for that period were $1.0 billion(3). We are incredibly proud of our history and eternally grateful, not just for the 5,000 employee-partners that are with us today, but for all of those who did the heavy lifting all along the way to allow us to reach the enviable position in which we find ourselves today.

The world is once again very challenging, and this is reflected in the capital markets. Certainly, we have made many mistakes along our path to Jefferies at 60, but those mistakes have also taught us much along the way. We might be celebrating our big birthday in the midst of yet another period of great challenge, but we thought we would share with all of you some of the most important lessons the two of us have learned along the way in our portion of helping to build Jefferies into the Firm it is today:

- Culture. Everything at Jefferies starts and ends with our people. A flat structure, open lines of communication and transparency foster a healthy environment and results in empowered people who are encouraged to be entrepreneurial, committed and driven to succeed. Nice people want to work with other nice people and so do clients. When people are happy, hustle is natural, as they don’t want to let each other down, and it is amazing to see how “lucky” teams become when they work hard and smart together.

- Count on Volatility. Every few years, our world turns upside down. Sometimes badly. You can keep building through cycles only if you keep arrogance out of your team and your business, encourage the immediate escalation of problems without shooting the messenger, raise capital when you don’t need it, invest heavily in risk systems and people, and create a Firm-wide attitude of “ownership” and “responsibility.” Appreciating the importance of aligning duration of capital with the uses of capital is paramount and will allow you to play offense at the most opportune time, while others are playing defense.

- Optimism. There truly is no limit to what an individual can achieve. When you are fortunate enough to have a Firm full of people who see the glass more than half full and work together as partners, then there is no limit to what the Firm can achieve.

- Consistency. Assuming you have a good strategy to begin with, there is nothing more valuable than people knowing exactly what the plan is and in what direction they are all marching together. Constant changes in leadership, mixed messages on priorities, political nonsense with agenda, competitor envy and “copycatting” and falling for the new “flavor of the month” are all recipes for disaster. It doesn’t mean there aren’t constant pivots and adjustments along the way, as more information is received or circumstances change, but if you want to get anywhere special it takes time and it’s best to consistently get there by everyone rowing at the same time and direction. It is also important to understand that nothing worthwhile happens quickly.

- Clients First, Always. This is not just a tag line and must be embraced as a way of life.

- One Firm. Many companies claim it and very few deliver it. Clients recognize when the entire Firm is delivered to help them solve their problem or seize their opportunity, and they also know when they are caught up in internal politics or similar nonsense. Equally important, if everyone understands and appreciates the health of the entire Firm will also affect their personal success, it is much easier for the Firm to handle the stress that comes with down cycles. Individual and group success must be rewarded, but nobody is operating in a vacuum. For all of us to win in the long term, we all must bear the brunt of supporting each other, especially in times of cross currents.

- Journey Not Destination. We have yet to declare victory in anything we do. There is room for improvement and growth in every aspect of our Firm. For us at Jefferies, nobody will ever hear us declare “mission accomplished.” This doesn’t mean we can’t celebrate a victory or a milestone such as our birthday. Whenever we see an individual or team go beyond the call of duty and accomplish something special, our Firm is the first to highlight the accomplishment and spread the appreciation and glory. But then, the sleeves must quickly be rolled up and onto the next client or challenge we go. That passion to constantly improve and gain ground for the benefit of our clients must be relentless. Staying constantly hungry and never being satisfied will keep us tenacious, humble, creative and proud.

Happy Birthday to team Jefferies and all of the people who have supported and enabled us to be the Firm we are today. The two of us are fortunate to have been the beneficiaries of thousands dedicating themselves to help build our Firm. We have grown in partnership with our remarkably successful clients who have always been incredibly demanding, but also wonderfully loyal and supportive. We look around today and find a world that is clearly challenged in many important ways and while some may see this period as frustrating and discouraging, we see it as yet another opportunity for Jefferies to re-define ourselves and eventually get to yet the next level. We are motivated, driven, excited and happy.

Who knew that 60 could be the new 30?!

Happy Birthday All,

Rich and Brian

RICH HANDLER

CEO, Jefferies Financial Group

1.212.284.2555

[email protected]

@handlerrich X | Instagram

he, him, his

BRIAN FRIEDMAN

President, Jefferies Financial Group

1.212.284.1701

[email protected]

he, him, his

(1) The financial measures presented herein include adjusted non-GAAP financial measures for 2011-15, which exclude the impact of the results of operations of Bache, a business substantially exited in 2015. See the Jefferies Financial Group Additional 2020 GAAP Disclosures at http://ir.jefferies.com/2020GAAPDisclosure for a reconciliation to GAAP measures. Net Earnings (Loss) in 1990-2012 are attributable to Common Shareholders. Net Earnings in 2013-2021 are attributable to Jefferies Group LLC. Jefferies Group’s results in 2013 for the Successor period includes the results of operations for the first quarter ending 2/28/13, which are part of the Predecessor period. The Predecessor and Successor periods are separated by a vertical line to highlight the fact that the financial information for such periods have been prepared under two different cost bases of accounting. Results in 2010 are for the 11 months ended November 30, 2010. “Predecessor / Successor” line delineates merger with Jefferies Financial Group.

(2) 2008 post-tax loss of $541 million includes expenses of $427 million related to the modification of employee stock awards and restructuring activities, offset by $434 million equity raise. 2018 GAAP net earnings attributable to Jefferies Group LLC of $159 million are adjusted to exclude the provisional tax charge of $165 million related to the enactment of the Tax Cuts and Jobs Act that was recorded in the year ended November 30, 2018.

(3) Global revenues for the last 12 months were $6.4 billion and net earnings for that period were $1.0 billion (Source: JFG Consolidated Financials).