Dear Clients, Jefferies Employee-Partners, and Friends,

With the end of the first calendar quarter of 2023 complete, once again the financial world feels “on fire.” Interest rates are still rising, inflation remains unchecked, two top 20 U.S. banks were put into receivership and auctioned off, and we just witnessed an emergency “shotgun wedding” to protect the world from the imminent demise of a systemically critical global bank. The financial news is dominated by discussions about asset/liability mismatches due to rapidly rising interest rates and the resulting mark to market losses, protecting consumer deposits above the federally mandated $250,000, and which large bank could be next to stumble. It is almost enough to make one forget that there is a European war going on “real time.” Though we can NEVER FORGET the Ukrainian war because the unprovoked attack on innocent people makes the financial calamity pale in comparison, but you get our point.

So how do all of us put this new financial crisis into perspective as we focus on our day-to-day responsibilities as we manage our businesses, investment portfolios, co-workers, families and friends? It is very easy to get sucked into the abyss and focus on the day-to-day minutiae of putting out fires caused by the second and third level effects that emanate from the serious financial issues we have just mentioned. In times like these, nothing enables us to see the big picture better than stepping back from the immediate fires (yes, we still need to put them out hourly) and taking a look at the very big picture over a widely extended time horizon.

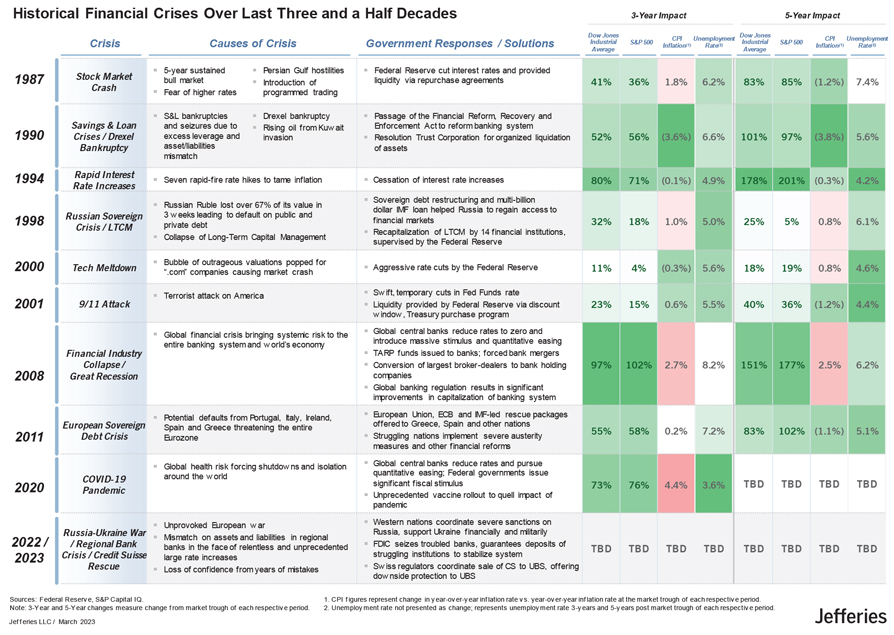

For that reason, we prepared the slide below that shows the periods of economic and market challenge the two of us have experienced these past three plus decades:

Some observations from this smorgasbord of turmoil:

- Our world always finds a way forward. In fact, things are usually pretty darn good in a surprisingly short period of time after we avoid often anticipated the “end of the world.”

- Government intervention, while never ideal or desired, can help solve very complicated and broad problems. The goal, though, should be to make much-needed changes in regulation, incentives and culture throughout our system during periods of relative calm to avoid/minimize future problems and reactive intervention.

- People or institutions that do not have a strong foundation, constitution or character can easily be wiped out at the bottom of the cycle. This has broad implications why the right culture, capital structure, temperament and ego during good times (which always precede bad times) is so important.

- People or institutions that panic, freeze or flee when times are at their darkest deprive themselves of participating when the sun comes out once again.

- People or institutions that buckle up, put out the fires, remain calm, encourage their partners to do the same, and stay the course even when it feels like there is no reason or reward to keep marching on, are often the ones who get magnified positive results when the storm passes.

- The smart, well-fortified, pre-prepared, and forward-looking people or institutions that have the luxury and nerve to play offense during these especially turbulent times can find themselves at another higher level (in almost every aspect) when the sun shines again, if they play their cards properly.

- The reason why people or institutions who focus on the long term versus the short term always win is because this roller coaster never ends. The twists and turns and ups and downs may always look and feel completely different, but when you step back and look from a distance, there are enough patterns and similarities that will help thoughtful minds make sense of it all.

When we look back at these past three and a half decades at Jefferies, we marvel at our corporate and investing clients who have best navigated the storms along the way. We have seen (and hopefully helped) corporate and private equity clients build amazing world class companies, consolidate industries and create enormous economic and social value. We have seen (and hopefully helped) our investing clients generate exceptional long-term, alpha-based returns for their shareholders and even build large, multi-faceted asset management platforms. Both groups of clients have driven change and created positive economic and social benefits for our society.

That said, having lived through so many financial crises, we are acutely aware of the pain and serious ramifications each one has caused, particularly the hardship of losing a job, a beloved firm you’ve given a large part of your life to, and the often gut-wrenching personal and societal economic impact that follows. Today is one of those times. But while extremely unsettling and painful (especially to those directly affected), we do not believe the current financial situation compares in systemic magnitude to the other crises we’ve witnessed and are included in our chart.

To us, the salient takeaway is when we look back at this chart and combine it with our intimate knowledge of our vibrant and impressive client base, it is apparent which characteristics the most successful individuals and companies share. They are all consistent year in and year out. They have a strong foundation both in capital and culture. They share the gift of zero arrogance and while they keenly embrace their current reality, they also have the gift of being able to anticipate change. They strike the right balance of patience and aggressiveness, while remaining calm regardless of circumstances. None of them ever give up, and while they all share a keen sense of urgency, they all prioritize the long term.

We at Jefferies always strive to do the same, and we humbly admit that it is not always easy to do so. We clearly make a lot of mistakes, but on balance our partnership with each of you allows us to minimize them, and stick to what we most enjoy:

Working to build value with all of you by focusing on the long term, regardless of the current climate, crisis or calamity.

Once again in the bunker with each of you, but enjoying every moment as we persevere and continue to build together, and knowing that we will all come out together on the other side, sooner than we might expect,

Rich and Brian

RICH HANDLER

CEO, Jefferies Financial Group

1.212.284.2555

[email protected]

@handlerrich X | Instagram

he, him, his

BRIAN FRIEDMAN

President, Jefferies Financial Group

1.212.284.1701

[email protected]

he, him, his