How Can Tech Growth Companies Avoid Missing Their Moment?

Three years after the technology IPO market began declining, the IPO window appeared to be opening in the first few months of 2025. Despite market volatility and policy uncertainty, quality companies were poised to go public amid strong investor demand. However, the White House’s seismic April 2nd “Liberation Day” tariff announcement has, at minimum, delayed the IPO plans of several companies.

As investors sort through the impact of this radically altered trade environment, some of the world’s top technology investors and company leaders will gather for the Jefferies Private Growth Conference on April 22-23 in Santa Monica, CA. We recently spoke with Evan Osheroff, Jefferies’ Managing Director of Software Investment Banking, to get his take on what’s shaping the technology market and where it’s headed.

Q: The White House tariff announcements caused immense short-term disruption. But do you expect it to fundamentally impact the trajectory of technology industry deal-making this year?

Evan: In addition to causing short-term disruption, it further cemented an environment of volatility, which is even more critical to overlay on the deal environment. As advisors and investors, we can’t control policy. All we can do is react to it. In the first few months of 2025, we already saw a dozen deals featuring venture-backed companies being acquired or going public at billion-dollar-plus valuations. So, the investor interest we expected to have coming into the year was undoubtedly there. I think it will still be there when the smoke clears a bit from the recent market volatility. We have companies in the IPO pipeline that are ready to go imminently and are just taking a week-by-week approach as to when to launch their offering.

In the meantime, investors need to stay focused on company fundamentals and recognize that when it comes to Washington, the only certainty for the next few years is likely to be uncertainty.

Companies, both public and private, venture-backed or in private equity portfolios, will have to accept volatility as the new norm. If people wait for things to calm down and become comfortable, there will be no M&A activity, IPOs, and limited capital returned to LPs. I don’t believe that is how this will play out, and the first few months of 2025 certainly suggest companies and investors are willing to transact despite the volatility.

Q: What is the current state of the IPO market, and what can we expect in the near future?

Evan: We are seeing some positive signs and increased activity, which we expect to continue. Companies are starting to select their underwriters and getting prepared, and interest in IPOs is definitely high. Business health is good, and valuations are more realistic than a few years ago. The problem recently has been a lack of supply. There have been too few IPOs, and people hesitate to be the first mover.

Many good companies are waiting in the background if they have a strong balance sheet. Clearly, some will choose to wait a bit longer as they assess the impact of tariffs and any knock-on effects they have across the market. Nonetheless, you have several notable fintech names ready to go. There are also several large software companies valued in the tens of billions that could go public any time they want, and we expect at least some to start sooner rather than later. Although there has been less activity in enterprise, a broad array of companies across various tech sectors are getting prepared for a potential IPO.

If these companies have a large cash pile and don’t have to do anything, they will not rush out. In the meantime, many companies are doing secondaries to provide liquidity to their employees and investors.

Our advice to companies considering an IPO is to worry less about a macro market window and more about your own window when you are growing fast, making the transition to profitability, and leaving plenty of runway for public investors to accrete value in their portfolios.

Q: Can delaying their IPOs create problems for these growth companies?

Evan: I don’t think enough people are talking about this. There are plenty of good reasons for private companies to do secondaries, but at a certain point, you are kicking the can down the road. Over time, these companies will have increasingly impatient employees eager to monetize their equity. They also run the risk that there won’t be enough value for public investors to capture by the time they do an IPO. If you do secondaries for too long, you may miss your IPO window and the great valuations – and payouts – that were once possible.

Q: What are your thoughts on AI as a near-term source of revenue and profitability?

Evan: AI presents a huge opportunity for growing revenue and scale. However, profitability may be years away.

I believe companies that deploy AI will create the greatest value. We are already seeing companies crossing $100 million in revenue in a matter of months, not years. Is that sustainable? We’ll see. Eventually, though, AI will generate substantial revenue and enormous value, uplifting pricing, capabilities, and competitiveness. Next up is the 10-person, $1 billion revenue company. That is not very far away from where we are today.

Q: Do you think people overestimate the magnitude or near-term payoff of the AI revolution?

Evan: AI, however you define it, will be infused into everything, including AI agents, foundational models, better analytics, and enhanced search capabilities. I have a firm conviction that it will change and transform everything.

One of these AI companies hoping to do an IPO will be the next Netscape, and another will be the next Google. But no one knows which one it will be.

Q: The arrival of DeepSeek in the public mind was a big moment. It wiped out a significant portion of the market capitalization of major companies that day. Is it having a lasting impact on software companies?

Evan: It’s less about DeepSeek specifically having an impact on software companies and more about showing what is possible in a world of open source and how critical that is to innovation. DeepSeek effectively showed that models can be copied, and innovation can be applied to achieve spectacular results. That is why companies are moving so fast and raising so much money. We are still at the beginning of the innovation curve, and that is exciting.

After a Record Run, Can India’s IPO Market Regain Momentum?

In 2024, 338 companies went public on the National Stock Exchange of India (NSE) and BSE, raising a record $21 billion. By year’s end, India was one of the world’s hottest IPO markets, with its volume matching the combined total of China and Hong Kong.

More recently, though, Indian public markets have lost steam. The Nifty 50 index, which tracks the country’s top-50 public companies, initially dipped on concerns over the Trump administration’s anticipated tariffs and continued to slide as more details emerged.

What does this mean for public offerings? It may be too soon to tell, but some investors view current IPO aftermarket performance as a warning sign. More new listings have struggled than succeeded in recent months.

Jibi Jacob, Head of Equity Capital Markets at Jefferies India, believes that broader market conditions—not IPO pricing or quality—are to blame.

“India’s market cap. has decreased from $5.5T to $3.7T, and IPOs feed on what is happening in secondary markets,” he said at a recent conference. “But if you look at the top 20 IPOs, mean returns are 25-28%. If pricing were wrong, returns would be more negative.”

Jefferies Insights caught up with Aashish Agarwal, the firm’s India Country Head, to discuss the country’s IPO pipeline. This follows his Q&A last fall, where he spoke about India’s growth story and the backlog of large companies eyeing public offerings.

Jefferies was recently recognized as India’s ‘Best Investment Bank’ by Global Finance.

India’s IPO Pipeline: Crowded but Stalled

Before analyzing the current market, it’s helpful to look back at recent trends in Indian public issuances, which, until November 2024, had ranked among the world’s most active.

In 2023 and 2024, Indian IPOs grew in number but even more in scale. Public issuances rose 22.6% from 2023, while fundraising volumes jumped 139%.

In 2023, small- and medium-sized enterprises led the IPO surge, nearly tripling new issuances from the year before. By 2024, larger companies entered the mix, and going into 2025, several of India’s unicorns were expected to go public.

Now, the outlook for large-cap IPOs is uncertain. No “mainboard IPOs”—listings from large, established companies—have launched for four consecutive weeks. New issuances have primarily come from the small and mid-cap segment.

“Though we have not seen sizable IPOs in the last few weeks, year to date nine companies got listed and cumulatively raised $1.8B. In the last two months or so, when the market has seen corrections, there are eight or nine issuers who have mandated banks for their potential listing with issue size greater than $1Bin the next 12 months,” Agarwal explained. “Since IPOs take 6-9 months for listing, being in the state of readiness is the key right now.”

A growing backlog of high-profile businesses has been cleared for public issuance but remains on the sidelines for now. So far, 34 companies have received approval to raise $4.8 billion this year, while another 55 are awaiting clearance for up to $11.4 billion, according to a leading Indian brokerage and asset management group cited by the Financial Times.

Has IPO Pricing Run Too Hot?

For two years, companies have capitalized on strong valuations in India’s public markets, which have become some of the most expensive globally by price-to-earnings multiples. The 2024 hot streak of IPOs added to the appeal. A study of 162 IPOs last year found that more than 82% traded higher after listing.

This stood in contrast to IPO markets in the U.S. and Europe, where new listings have struggled for years.

Some investors are asking if valuations have overheated. Reuters recently highlighted India’s largest IPO of 2024—a subsidiary of Korea’s Hyundai Motors. While the parent company trades at a 3.7x forward price-to-earnings multiple, its Indian subsidiary trades at 22x. Indian units of Japanese and European companies have seen similar valuation premiums.

Are 2025’s IPOs struggling in aftermarket trading due to inflated valuations, or is their performance simply mirroring broader market declines driven by tariff threats and other pressures?

“The two sizable IPOs of this year, Dr. Agarwal’s Health Care ($350 M) and Hexaware Technologies ($1B), have stood the test of recent market volatility. Both are above their issue prices currently,” Agarwal said. “We believe the aftermarket performance of 2024’s IPOs is currently driven by broad market performance and outlook.”

A Necessary Reset for Indian Markets

Some financial leaders see reason for optimism in India’s market performance, including Jefferies India’s Head of Research, Mahesh Nandurkar. In a recent appearance on CNBC India, he points to signs of stabilization in Indian benchmark indices and describes the recent downturn as a necessary reset.

“This much-needed market correction is now, I think, behind us,” he said. “Valuations are now down closer to long-term averages, and fundamentals are showing signs of improvement.”

His remarks come at a time of heightened volatility for U.S. public equities. Historically, turbulence in the U.S. has rippled into emerging markets—but this time could be different.

Nandurkar thinks the extended bull run in U.S. equities may have dampened investor appetite for emerging economies. Now, with uncertainty around tariffs and trade policy weighing on the U.S. economy, American investors may start looking elsewhere for returns. India could stand to benefit.

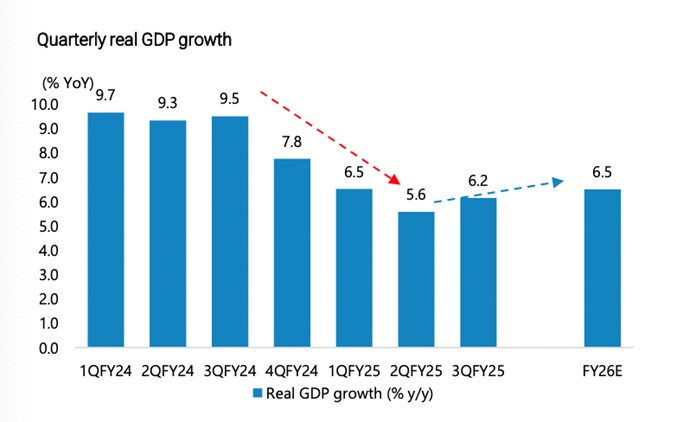

Source: MOSPI, CEA, Jefferies

Growth projections for the Indian economy reflect this. After the shallow slowdown of recent quarters, GDP growth is expected to rebound to 6.5% CAGR.

The panel cautioned that it’s too soon to call the trajectory of Indian public markets. But if the correction is truly in the rearview, it could set the stage for a stronger IPO pipeline.

Searching for Growth in Emerging Markets

As IPO activity lags in developed markets, investors are turning to emerging economies for opportunities. Indian public equities may be expensive, but they’ve delivered strong returns for years.

The question now is whether the recent IPO slowdown signals a deeper shift or just a temporary setback. With several high-profile companies still waiting to go public—and fresh positive signs for India’s economy—many eyes will be on India’s markets in the weeks ahead.

For more insights from Aashish Agarwal and Jefferies’ award-winning India team, read his Q&A on Jefferies Insights: What Will Drive India’s Growth for the Next 20 Years?

What the Global Political Shift Means for Energy

Just two months into the new U.S. presidential administration, the conversation—and regulatory framework—around energy is shifting dramatically. Yet global energy trends unfold along much different trajectories and timelines than those governing politics. According to Pete Bowden, Jefferies’ Global Head of Industrial, Energy & Infrastructure Investment Banking, this is why most energy investors and leaders with whom he speaks are moving with patience and deliberation.

This week, Pete and his team are host to several hundred senior leaders from the U.S. and globally at the Jefferies Energy and Power Summit in Houston. There, they are to discuss the most consequential trends shaping global energy markets. In advance of the gathering, we sat down with Pete to get his take on a few key questions likely to be on the minds of meeting attendees.

Q: What will the near-term impact of the energy regulatory changes from the Trump Administration be?

A: The changes may not be as seismic as some think.

The perception that everything would change the day Trump entered the Oval Office in January ignores the realities of this industry’s lead time and decision-making process. When you think about major oil companies, you think about aircraft carriers, not PT boats. Once they have their 2025 drilling plan set, which is halfway through 2024, they don’t change it based on the outcome of an election.

Let’s say the Keystone XL pipeline is approved tomorrow. It will still take years to build and will not be in service until after Donald Trump leaves the White House.

Daniel Yergin likes to remind people that the president of the United States does not determine supply or demand or set the oil price. Donald Trump can, and likely will, ease up on permitting, allowing the industry to initiate activity on federal onshore lands or offshore blocks that it could not effectuate under President Biden. Even if that happens, though, oil companies will still move deliberately. For example, if President Trump were to open drilling in the Arctic, companies would still have to assess the liability and reputational risks of exploring there.

Ultimately, leaders in this sector want sensible public policy that recognizes fossil fuels as global commodities, and that the domestic availability of hydrocarbons solidifies American companies’ leadership role in the world.

Q: What will change at the Federal Trade Commission mean for the energy industry?

A: The Trump administration initially announced that it was retaining some core components of the Biden administration antitrust framework, suggesting there could be more continuity at the Federal Trade Commission than some expected. However, more recently, President Trump announced the firing of two Democratic members of the Commission. I do think the general attitude toward energy sector mergers will change. During the Biden administration, it seemed like almost every energy combination was reviewed, even if it had zero or negligible anti-competitive characteristics. Still, the FTC would ask select questions or issue a full second request, causing delay or risking a blocked deal.

Now, under President Trump, industry participants with wish lists that include deals they did not think could get through the FTC or DOJ will try to make those deals happen over the next few years.

Q: We’ve entered a higher-risk world with tariffs, potential trade wars, and shifting alliances. What will the impact of that be on the energy industry?

A: It has highlighted the importance of U.S.-produced hydrocarbons for the U.S. market. No matter the trade regime, we are the most significant end market.

Everyone is lining up trying to buy U.S. inventory because the production is proximate to the best end market. You know, at least directionally, what the regulatory regime will be.

Outside the U.S., one must worry about tariffs and shifting winds across different regimes worldwide. The U.S. has long been the most important end market and may now be the most important producer, so it is attractive in both ways.

Q: What is the state of the global energy transition?

A: In places like Europe, governments and voters are realizing that oil and gas will still be necessary for a long time to come because the energy transition has proven harder, more costly, and slower than some anticipated.

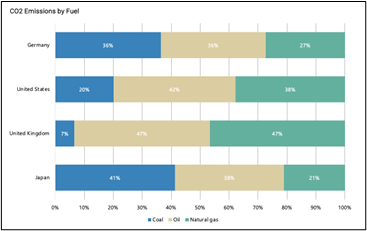

People are also learning that moving too quickly away from existing reliable energy sources can have serious, unexpected ecological consequences. For instance, Germany decommissioned nuclear power plants and assumed they could add enough offshore wind and solar energy to compensate. They could not. Consequently, Germany burns lignite coal in power plants to get through the winter. That is 1930s technology with a high carbon output per unit of electricity produced.

Q: How do you think the established players in the global energy industry can help fast-developing countries meet their demand?

A: The developing world needs the expertise and support of the developed world to meet its energy requirements correctly. If we do not provide them with that expertise and support and they do it the wrong way, it does not make a difference what we do in the lower forty-eight states on carbon capture or anything else. That is a drop in the ocean if we return to coal as the world’s flex fuel.

Focusing on the U.S. alone is like declaring a no-peeing section in the swimming pool. It just doesn’t work. Greenhouse gas emissions are a global challenge that requires solutions deployed globally.

Q: How do the significant investments the U.S. has made in renewable energy figure into the global picture?

Remember that the United States only accounts for about 14% of global carbon emissions, and our share is declining. Solar and wind deployment is growing rapidly here and worldwide and will likely continue. However, fossil fuels still account for over 80% of global energy demand.

To understand why, remember that over a billion people live in energy poverty worldwide, and fossil fuels are often the most available, affordable, and reliable option for countries to meet their energy needs.

Take India. India is electrifying and trying to do so with LNG, the right bridge fuel. However, President Biden’s previous export ban on LNG caused the country to pivot back to coal. This is a global problem that needs to be addressed globally.

Q: What should leaders in the energy industry think about that may not be at the top of their minds right now?

A: The industry should consider where it will be in 30 years. And that is hard for public companies to do. They need to make their numbers every quarter and have annual planning and deployment of capital cycles.

The industry needs to explain that even if fossil fuels are reduced in the power and transportation sectors, oil and natural gas liquids are still used in just about every household good. The idea that we will completely wean ourselves off oil is unrealistic.

If you believe that carbon capture and sequestration will be part of our carbon emissions control, oil and gas companies’ downhole expertise will be necessary. Carbon goes into depleted reservoirs, and the people who know how to put it there are the same people who took it out. These are big, multi-year projects with high capital intensity and a rigorous engineering overlay.

If you are a large oil company or energy producer, you should offer the public and policymakers a clear vision for how you can write the next chapter of this industry and ensure that energy is cleaner and more abundant.

European Mid-Cap Outlook: Q&A with Dominic Lester, Edward Keen, and Lorna Shearin

Now in its fifth year, the Jefferies Pan-European Mid-Cap Conference has quickly established itself as a marquee event for investors and corporates focused on Europe’s mid-cap universe. Launched during the pandemic as a virtual gathering, the conference has evolved into one of the largest and most impactful events of its kind. This year, it returns to London with 190 participating companies (up from 167 in 2024) and 525 investors confirmed, representing 286 institutions worldwide.

The 2025 conference reflects Jefferies’ strategic commitment to supporting mid-cap companies across Europe. Investor attendance is up 47% year-on-year, with 36% of participants now coming from outside the UK, reflecting the rising global appetite for European mid-cap opportunities.

Ahead of this year’s conference, we sat down with Dominic Lester, EMEA Head of Investment Banking; Edward Keen, Head of Equities EMEA; and Lorna Shearin, Deputy Head of EMEA Investment Banking, to discuss the themes shaping the European mid-cap landscape and what to expect from the event.

European Mid-Cap Outlook

What are you most excited about as we head into this year’s conference?

Dominic Lester: From a macro perspective, Europe’s momentum is building. Ironically, recent US political shifts have pushed Europe towards greater economic coordination. The UK is moving closer to Europe, Germany has reawakened following Merz’s electoral victory, and we’re seeing renewed energy in Southern Europe, particularly Greece and Italy. Funding is available, debt financing remains resilient, and equity markets are competitive. All of this creates a fertile backdrop for mid-cap companies. It feels like the start of a European economic renaissance.

Lorna Shearin: The Jefferies Mid-Cap Conference is a unique event, and we always look forward to connecting with so many of our UK and European investment banking clients. This year, we have 65 UK corporates participating, and the conference provides an excellent opportunity to showcase them—particularly our UK broking clients—to a broad pool of global institutional investors. It promises to be an interesting three days as we hear how these companies are navigating shifts in technology and macroeconomic conditions, and how these factors are shaping their M&A and growth strategies.

2025 marks the conference’s fifth year—what makes this year’s conference stand out?

Dominic: It’s truly international, bringing together participants from across Europe and beyond. This reflects Jefferies’ long-term strategy to support the mid-cap universe. We’re seeing a diverse range of growth-oriented leaders—70% of companies are represented by C-suite management, with many new and returning names.

Edward Keen: I’m excited by the scale of participation—it’s becoming a bit of a marquee event! We now have 190 corporate attendees, with a third from the UK. The 125 European corporates represent a full range of sectors and include some of the most dynamic and exciting mid-cap companies in Continental Europe. On the investor side, we’re seeing large teams attending, some with up to 10 investment professionals. That shows deep institutional commitment and highlights Jefferies’ differentiation across trading, research, and banking.

How do you see the European mid-cap landscape evolving over the next 12–24 months?

Ed: We’ve expanded from a UK-centric model to pan-European coverage over the last few years. Mid-caps have always been a core focus for Jefferies, and there’s a strong case for European mid-caps right now. Valuations are compelling—most would argue they are cheaper than their US peers—and there’s real potential to find alpha. Our advisory expertise makes us a valuable partner to institutional investors.

Are there sectors or geographies where you expect significant deal activity or consolidation?

Dominic: Consolidation is accelerating in financial services, particularly in Italy, and we expect it to continue across Europe. Pharma remains active, and aerospace and defence are obvious areas given increased local defence spending. The IPO market is slowly reopening—we’ve seen corporate carveouts and private equity funds tap the public market to exit some assets that might be too large to sell, like Galderma. The constraint on European IPOs has been on the supply side, but I think we’ll see more high-quality companies coming to market, like Visma, Verisure, and other high-profile names such as Revolut. I don’t foresee a blockbuster IPO year, but it’s warming up and setting the stage for 2026. There’s also ongoing restructuring among over-leveraged companies, which will drive more M&A.

Lorna: Overall, deal activity remains healthy, particularly in technology, healthcare, energy and energy transition, and infrastructure, where we are seeing significant deal flow, including sponsor exits and public-to-private transactions. That said, the current geopolitical backdrop is making deal completion less certain and timelines to close are often longer. Geographically, Germany and the UK will likely remain focal points for many of our clients. It is the drive for innovation, sustainability, and digital transformation that continues to be the principal force behind M&A activity in the near and medium term.

Are institutional investors becoming more open to European mid-caps versus US opportunities?

Dominic: Yes. There’s a clear valuation arbitrage. Investors are still selective, but they’re looking for higher-growth opportunities—companies showing double-digit topline growth are in demand. In the UK, pension funds are under regulatory pressure to allocate more to public equities, which should help domestic demand as well.

Ed: Globally, we’re seeing US and AsiaPac long-only funds increasing their European exposure. We don’t really foresee people taking an overweight position—more of a rebalancing toward neutral. It’s important to remember that the liquidity profile of Europe is nowhere near as rich as the US. We have to tread carefully, but this could mark the beginning of a long-term shift. If there’s a resolution to the Russia-Ukraine crisis, there will be a resounding appetite for Europe, but things can change in an instant. Europe has its challenges—no one is totally immune to the effects of tariffs—but relative stability, predictability, and cheaper valuations are attracting capital.

Investor attendance is up 47%, with 36% ROW participation well above historical norms. What’s driving that international interest?

Ed: In my opinion, it reflects the diversification of global asset flows. Investors are moving away from being overweight in the US, and Europe is a key beneficiary. It also highlights the growing depth and breadth of Jefferies Corporate and Institutional investor clients. We are listening to what they want, and delivering!

Dominic: In addition, significant capital is flowing into Europe from the Middle East. Sovereign wealth funds and private equity investors there have both the capital and expertise, particularly in energy and industrial sectors. We’ve already seen large energy acquisitions in Germany and expect more to follow in industrials, petrochemicals, and beyond.

Any parting thoughts?

Dominic: This feels a bit like the 2020 reset. Historically, it’s been in the US’ interest to create military and economic dependence on the US. But as America turns inward, leaders in France, Germany, and the UK are taking the bull by the horns, and Europe is moving towards greater self-reliance in defence and energy security. I don’t think investors will sit on the sidelines in fear. People are shaken by geopolitical risks, but it’s prompting decisive action. This is a pivotal moment for Europe’s economy—and a huge opportunity for mid-cap investors.

Lorna: This is one of Jefferies’ flagship conferences, and it continues to grow year on year. In the same way that the Jefferies London Healthcare Conference has become a “must-attend” event in the annual calendar, we see our Mid-Cap Conference evolving in the same way. We’re delighted to host the event and to support both our corporate and institutional clients as they connect, grow, and flourish.

Ed: Make sure you sign up early if you want to come next year!

Data Moats, Infrastructure, and Agents: Where Investors See AI’s Next Big Opportunities

A Jefferies Insights Podcast

Evan Osheroff, Managing Director of Software Investment Banking at Jefferies, sat down with Don Stalter, North American Partner at Global Founders Capital, to discuss the trajectory of artificial intelligence (AI) and the opportunities growth investors are eyeing in the sector.

Their discussion covers the evolution of AI in business, the significance of data and operational expertise, the challenges and opportunities of investing in AI, the energy and infrastructure implications of AI’s growth, and emerging AI applications like autonomous logistics.

As a long-time investor and entrepreneur in technology, Don brings a unique perspective on what it takes for young companies to succeed in this fast-growing space — from building the right team to using open-source models to create application-layer businesses and AI agents. Mapping the AI market, where thousands of new companies launch each year, is no small task. Don and Evan’s conversation digs into the key questions investors should be asking and where the next big opportunities might lie.

Don Stalter is the North American Partner at Global Capital, where he has been an early backer of ten $1B+ unicorns. His most notable investment was in Deel, where he wrote the largest seed check and helped recruit key executives. Previously, Don co-founded CityDeal, a B2B marketing technology company acquired by Groupon in its early days. He also built out Groupon’s international offices and led global business development at Airbnb. Earlier in his career, Don worked in Credit Suisse’s tech M&A group and as a private equity investor at Savant Growth.

Evan Osheroff is a Managing Director of Software Investment Banking at Jefferies, with over 15 years of experience and more than $100B in completed transactions. He specializes in application and infrastructure software and has extensive expertise in M&A, IPOs, convertible offerings, debt financings, leveraged buyouts, and more.

How Japan’s GX Plan Aims to Decarbonize the Country’s Toughest Sectors

Jefferies recently wrote about Japan’s Green Transformation Policy (GX), a $1 trillion plan to dramatically reduce emissions over the next decade. This initiative represents nearly three times the annual GDP investment percentage of the U.S. Inflation Reduction Act — yet it has largely flown under investors’ radar.

Decarbonizing Japan’s economy comes with unique challenges and opportunities. Japan relies more on coal (the most carbon-intensive fossil fuel) than its high-income peers, and a large share of its energy is imported. At the same time, Japan can draw lessons from other countries’ transition policies and emissions trading schemes, giving it a significant second-mover advantage.

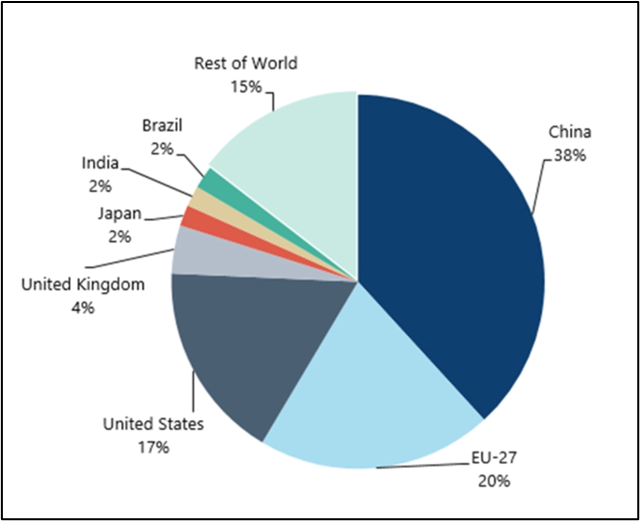

Historically, Japan has lagged in energy transition investment. Last year, it made up just 2 percent of global energy transition spending, despite being the world’s fourth-largest economy. Smaller economies, including India, the U.K., and Brazil, matched or outspent Japan in 2023.

The GX plan is specifically designed to address these challenges. It targets high-emission companies with an aggressive decarbonization strategy — aimed at maintaining their economic performance and the country’s energy supply.

Here’s how it works in five key steps.

- Target Setting: Japan’s slow start in the energy transition isn’t stopping it from setting ambitious, fast-moving goals. The GX Plan aims to reshape the country’s power mix by 2040, with 40-50 percent from renewables and 20 percent from nuclear. These targets set the stage for bold policymaking and investment — detailed in the steps that follow.

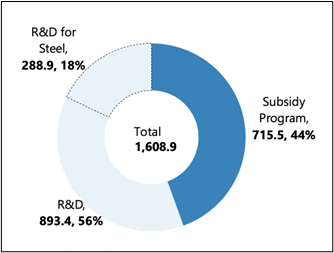

- Transition Sovereign Bonds: Between 2023 and mid-2029, Japan will issue ¥20 trillion in transition sovereign bonds. Unlike the “green bonds” of the IRA, which fund climate projects across the economy, transition bonds specifically help high-emitting companies lower emissions — moving from “brown” to “less brown” or “greener.” Proceeds will fund R&D through the Green Innovation Fund and support decarbonization efforts via the Subsidy Program, with a focus on Japan’s hardest-to-decarbonize sectors.

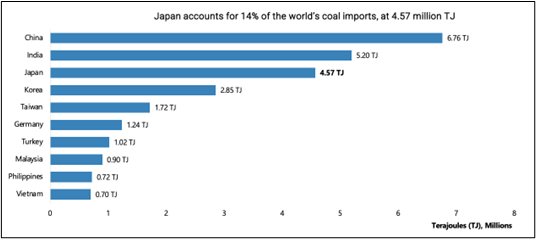

- Carbon Levy on Fossil Fuel Imports: Japan accounts for 14 percent of the world’s coal imports, trailing only China and India. Starting in 2028, it will introduce a carbon levy on fossil fuel importers, with rates increasing over time. Revenue from the levy will be used to repay the principal and interest on GX Transition Bonds. By linking fossil fuel imports to decarbonization funding, Japan is creating a built-in financial mechanism to curb coal dependence while sustaining long-term support for its transition strategy.

- A National Emissions Trading System (ETS): Japan launched its national ETS in FY2023, beginning with voluntary participation through the “GX League” — a group of 747 companies responsible for over 50 percent of the country’s GHG emissions. Notably, 18 of the 20 highest-emitting Japanese stocks (Scope 1 + 2) have joined. This voluntary phase runs through FY2025 before transitioning to a mandatory ETS in 2026. Japan has the opportunity to learn from the successes of ETS efforts in Europe, China, and beyond. More details on its plan will be released this year.

- An Innovation-First Approach to Climate Policy: Japan’s GX Plan prioritizes research and development in addition to subsidies — a strategy aimed at positioning the country as a global hub for climate tech and clean energy innovation. More than half of the transition bond proceeds will fund R&D through the Green Innovation Fund. The plan also dedicates JPY 200 billion over five years to deep tech startups and JPY 700 billion to support small and medium-sized enterprises driving the energy transition.

This chart illustrates the use of proceeds for the February Bond Auction (representing 1.6T JPY of the total 20T JPY to be issued).

Japan’s decarbonization path comes with unique challenges—but it’s being tackled with an equally unique strategy.

The scale and structure of the GX Plan—its incentives, R&D focus, and diverse climate finance tools—set Japan up for one of the most ambitious energy transitions in the developed world. Jefferies, and investors everywhere, should keep a close watch.

Follow along for more insights from Jefferies’ Sustainability and Transition Team on the Japan GX Plan and other important climate investing themes in the weeks ahead.

Grid Upgrades Are Lagging—Can Drones Change That?

Last February, Jefferies wrote that upgrading and expanding grid infrastructure was widely viewed as the biggest obstacle to a net-zero future.

Clean energy investment was surging, but grid development lagged badly. Existing infrastructure was severely unprepared for the projected load growth of the next decade.

A year later, new innovations aimed at modernizing the grid are gaining traction—and one, in particular, is turning heads. Infravision’s drone-enabled power line stringing uses unmanned aerial vehicles to install power lines faster and more cost-effectively than traditional methods.

Could this be the breakthrough that speeds up grid deployment while cutting costs and improving safety? Jefferies’ Sustainability & Transition Team sat down with Infravision’s founders to explore where drone-enabled power line stringing stands today—and what it could mean for the global transition.

This article recaps Jefferies’ interview with Cameron Van Der Berg, Co-founder and CEO of Infravision, and Brian Leveille, the company’s CFO. For a deeper dive into their insights, read the full report from Jefferies’ Sustainability & Transition Team.

A New Approach to Transmission Replacement

The United States needs to more than double existing regional transmission capacity by 2035, according to the Department of Energy’s 2023 Needs Study. A key piece of this effort is replacing aging power lines with new and advanced materials—an effort that’s expensive and, in some cases, risky.

Infravision’s drone-enabled approach is tackling the challenges of transmission replacement head-on. Its proprietary TX System pairs a heavy-lift drone with an electric smart puller tensioner, enabling automated, high-precision power line stringing across long distances.

According to Van Der Berg and Leveille, this system offers three key advantages:

- Safety: The drones take on high-risk tasks—like working at elevated heights or in difficult terrain—reducing the need for direct human intervention. This lowers the risk of accidents while allowing crews to stay focused on other critical tasks.

- Efficiency: Drones can reach remote areas that ground crews and helicopters can’t, helping to speed up project timelines.

- Savings: The system offers lower cost per phase mile than traditional methods while also reducing overhead expenses.

The founders believe these benefits position Infravision to significantly disrupt traditional power line installation.

Infravision’s Market Opportunity & Growth Strategy

Infravision’s drones aren’t just an R&D experiment—they’re already in operation, with real projects and growing scale. Their primary customers are utility companies and engineering, procurement, and construction (EPC) contractors, including a 50-kilometer, 250-megawatt high-voltage line with Powerlink Queensland.

Infravision has also partnered with PG&E to deploy its drones on power lines and is now working with Sterlite Power in India. As global power demand and electrification efforts accelerate, the company expects to expand its presence across international markets.

The company’s total addressable market is significant, backed by $200 billion in planned transmission capital expenditure and $870 billion in distribution capex and opex globally in the coming years. Following a $23 million Series A funding round led by Energy Impact Partners, Equinor Ventures, and Edison International, Infravision plans to double its workforce over the next year.

New Opportunities in the Energy Transition

Drone-enabled solutions create a wide range of opportunities for the energy transition.

They don’t just improve cost and safety efficiencies in transmission installation—they also shorten project timelines, freeing up skilled workers for other transition projects. Additionally, companies like Infravision make large-scale T&D construction more feasible in non-Western countries, where high costs have historically been a barrier.

For more on Infravision’s solutions, check out Jefferies’ full recap of the team’s recent conversation. For deeper insight into the energy transition, climate tech, and related opportunities, explore the Jefferies Sustainability & Transition Team’s work on Jefferies Insights.

Japan’s GX Plan: Is the World’s Most Ambitious Energy Transition Being Overlooked?

Nearly two years ago, Japan unveiled its Green Transformation Policy (GX), a $1 trillion plan to dramatically reduce emissions over the next decade. This initiative represents nearly three times the annual GDP investment percentage of the U.S. Inflation Reduction Act — and it aims to catalyze climate tech innovation in the world’s fourth-largest economy.

Surprisingly, GX has largely flown under the radar of institutional investors. Of the 400+ investors Jefferies recently engaged across the U.S. and Europe, only three were familiar with the plan.

Japan’s GX spans all areas of climate finance: carbon levies, emissions trading, transition bonds, and more. Given its scale — and the Japanese stock market’s outperformance over the past three years — Jefferies views it as a defining transition investment theme for the next decade.

In the coming weeks, Jefferies will outline GX’s core policies, investment tailwinds, and strategies for addressing Japan’s highest-emitting sectors. First, here are the eight things every climate investor needs to know about Japan and its approach to decarbonization.

- Japan is the world’s fourth-largest economy — at least. According to the International Monetary Fund, Japan’s $4.07 trillion GDP ranks 4th globally, behind the US, China, and Germany. Some calculations place it in 3rd.

- Japan is one of the world’s leading emitters. The International Energy Agency reports that Japan accounts for 2.9% of global emissions, the 5th highest globally. Since 2000, Japan’s emissions have dropped 15%, and its emissions per capita rank 23rd worldwide — compared to China, which ranks 25th.

Despite being one of the world’s leading emitters, Japan was just 2% of the total $1.8trn spent on energy transition in 2023.

- Japan’s GX Policy represents a larger percentage of its GDP than the Inflation Reduction Act does for the US. In a recent note, Jefferies encouraged investors to look beyond the US, especially as the IRA may not survive in its current form. It is also arguably more impactful on Japan’s economy than the IRA is on the US. Annual public investment under GX is 0.33% of GDP, compared to the IRA’s 0.13%. Factoring in both public and private investments, GX accounts for 2.47% of GDP, while the IRA is 1.04%.

- Japan has set several new climate targets, including a goal for nuclear power to make up 20% of the country’s energy mix by 2040. To achieve these ambitious goals, Japan is tapping into all areas of climate finance, including bond issuance, R&D investments, subsidies, carbon levies, and an emissions trading scheme.

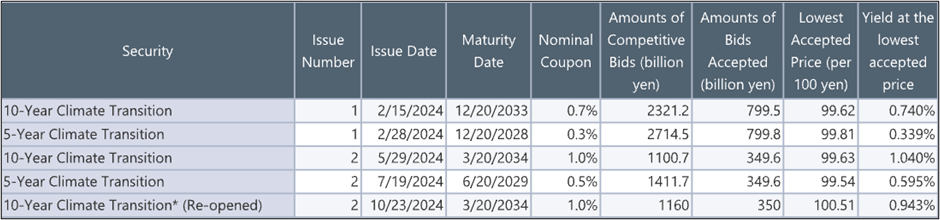

- Japan is issuing transition bonds as part of its GX vision. Japan will issue 20 trillion JPY (~$144B USD) of sovereign climate transition bonds over the next several years. In February 2024, the 10-Year Climate Transition Bond was priced at a 0.74% yield, slightly below regular Japanese 10-year government bonds at 0.755%.

In 2024, Japan issued ¥2.65 trillion (~$17B) across 5 bond auctions. The first bond auction of 2025 is scheduled for January 29.

- Japan plans to impose a carbon levy targeting fossil fuel importers. This levy will gradually increase over time, with the proceeds allocated to repaying the principal and interest of the GX Transition Bonds. Notably, Japan currently accounts for 14% of global coal imports.

- Japan’s GX League is trialing the emissions trading scheme (ETS) for high-emission sectors. Introduced in 2023, it started with voluntary participation from the GX League — a group of 747 companies accounting for >50% of Japan’s emissions. From 2026 onward, the ETS will be mandatory.

- Japan is betting on R&D to drive a carbon-neutral future. Unlike the subsidy-heavy U.S. IRA, Japan’s GX policy focuses on directly supporting R&D through the Green Innovation Fund, which is supporting innovation at the country’s leading companies. In February 2024, 55% of bond auction proceeds were allocated to R&D initiatives.

Many of the key elements of Japan’s GX Policy are still taking shape, but there’s no question this plan merits investors’ attention. Jefferies’ team will continue to monitor the decarbonization of one of the world’s leading economies — and the economic growth and innovation this strategy aims to ignite.

Follow along for more insights from Jefferies’ Sustainability and Transition Team on the Japan GX Plan and other important climate investing themes in the weeks ahead.

Ten Questions for the Energy Transition in 2025

It’s too soon to predict what 2025 will mean for the energy transition. Much depends on the incoming administration’s policies, the resolution of global conflicts, and the direction of emerging technologies. As S&P Global Commodity Insights wrote in their 2025 outlook, “there is more uncertainty in energy markets heading into a new year than any year since the pandemic.”

Jefferies’ Sustainability & Transition Team is entering 2025 with ten key questions, covering the challenges and opportunities shaping the global transition. While the team brings perspectives on these issues today, developments in policy, technology, and markets could lead to a range of outcomes in the year ahead.

- Is the energy transition a viable investment theme for equity investors?

Yes, despite the underperformance of clean energy equities (ICLN) relative to oil and gas (IEO). The energy transition is much bigger than the performance of solar and wind producers compared to traditional energy companies.

Jefferies compiled a list of approximately 1,000 public equities across 27 subsectors related to the energy transition, representing a combined market cap of $18 trillion. A detailed analysis of the broader universe tells a different story about the transition’s investability and performance. Expect further insights on this subject in 2025.

- Will Climate Tech 2.0 repeat Climate Tech 1.0?

The team remains cautious about the scaling challenges facing climate tech companies, often referred to as the “missing middle.” These companies, struggling to transition from pilots to larger-scale projects, face significant hurdles, particularly in securing capital.

Jefferies has identified over 1,000 promising climate tech firms—across energy storage, sustainable aviation fuels, green hydrogen, nuclear, and more—that need significant scaling-up capital. In a high-interest-rate environment with uncertain government funding, this could be a challenge.

On January 13, 2025, Jefferies will host a seminar featuring leaders in climate tech, including Decarbonization Partners, Spring Lane Capital, Sila Nanotechnologies, and Commonwealth Fusion Systems, to explore these issues and investment opportunities further.

- Will investors look outside the U.S. for opportunities in the transition?

Jefferies anticipates a more global approach to energy transition investments in 2025. While U.S. investors have largely focused on the Inflation Reduction Act since its passage, significant decarbonization initiatives in countries like Japan, China, India, UAE, Saudi Arabia, and Brazil have been overlooked.

The firm expects global programs such as Japan’s GX Plan to gain investor attention as U.S. enthusiasm slows during a political transition. Jefferies sees these international markets as rich with opportunities in specific transition sectors.

- Is 2025 finally the year of climate adaptation?

Climate adaptation is a multi-trillion-dollar investment opportunity as economies worldwide contend with increasingly extreme weather. Data from the EU’s Copernicus Climate Change Service indicates that 2024 will be the hottest year on record, marking the first time global temperatures exceed 1.5°C above pre-industrial levels.

This year, Jefferies has highlighted investable themes like heat resilience, urban climate adaptation, and water management, offering stock ideas to address these challenges. The firm hopes to see more investment vehicles developed in public markets to support these critical areas.

- How will the carbon removal industry evolve?

Jefferies maintains long-term confidence in the carbon removal industry due to its necessity in reducing atmospheric CO₂ levels and its support from major governments and tech companies like Microsoft. However, the industry is going through transition, and Jefferies anticipates industry consolidation among the 800+ carbon removal companies currently operating.

Jefferies is producing a 15-part series, “How to Build a Carbon Removal Company,” featuring leaders from Direct Air Capture, Biochar, and Marine CDR, offering insights into where the sector is headed in 2025.

- How will companies commercialize sustainability?

Outside of the energy transition, companies across sectors are seeking to commercialize the sustainability megatrend.

Jefferies has developed a 10-part framework for how businesses can commercialize sustainability through capital raising, M&A, joint ventures, carbon markets, regulatory incentives, and more. Data from 1H24 showed sustainable debt surpassing $5 trillion since 2006, while green M&A activity continues to grow by both value and volume.

As companies move from “awareness-building” to executing sustainable strategies, Jefferies will use its framework to track developments and identify best practices across industries.

- Will AI agents change the labor market?

Jefferies has focused on human capital issues for nearly four years, and in 2025, artificial intelligence will be the firm’s singular focus.

Jefferies expects AI agents to be a transformative force in the labor market in 2025. These software programs, capable of independently performing tasks to achieve human-set goals, are being developed by companies like Salesforce, OpenAI, and Microsoft.

AI agents are already enhancing workflows, such as Salesforce’s Agentforce tools for sales and customer service. McKinsey estimates that generative AI could create over $2.6 trillion in annual value, with AI agents driving much of this impact.

- Which Republican Party becomes dominant: free market or populist?

Jefferies sees growing tension within the Republican Party between its traditional free-market faction and an increasingly influential populist wing. While the free-market camp champions deregulation and lower taxes, the populist side emphasizes trade protections, anti-Big Tech sentiment, and pro-worker policies.

How these factions influence the party’s economic agenda—particularly under the incoming administration—will shape policy debates around tariffs, unionization, and taxes in 2025.

- Will deregulation succeed and could it accelerate the energy transition in the US?

Jefferies is optimistic about the success of a deregulation agenda, including the Department of Government Efficiency (DOGE). In particular, the firm is monitoring deregulation’s potential to advance U.S. infrastructure projects critical to the energy transition. Proposed reforms to the National Environmental Protection Act (NEPA) could streamline permitting for grid infrastructure, nuclear projects, and utility-scale solar.

The firm will closely monitor developments under the incoming administration’s deregulation and government restructuring initiatives, which could provide bipartisan momentum.

- Will there be a global peace dividend in 2025?

2024 was a violent year. The ACLED’s Conflict Index shows global conflicts doubling over the past five years, spanning 50 countries.

Although most analysts expect extended global conflict, Jefferies believes the new administration could accelerate resolutions in Ukraine, the Middle East, and possibly China. A “peace dividend”—economic benefits from reduced defense spending—could follow, mirroring similar trends from the 1990s.

Jefferies plans to study the investment implications of such a shift, exploring opportunities that could emerge if global conflicts de-escalate in 2025.